Oil - Inflation - Silver & Gold

Published 8/24/05

Crude oil at record high prices above $60 per barrel inspired uncountable current articles on the inflationary effects of high energy prices and the historical ratio of gold to crude oil. As in his previous commentaries, the Optimist strives to present a positive perspective for readers to consider. The uplifting message for today is that high oil prices will not cause higher inflation, and that inflation adjusted oil prices will not stay this high for long. The Optimist hopes that helpful message will provide a soothing reassurance to consumers who must struggle to find the funds to pay the crude oil inspired increased prices for gasoline and heating oil, for food, and for everything impacted by higher transportation costs.

Energy costs are a tax

There are few more certain economic relationships than that rising energy prices will directly translate into escalating prices at the gas pumps, in the grocery store or restaurant, and in the mailbox at home when the monthly utility bills are delivered. Increasing transportation costs will also push a broad spectrum of prices higher. Although those persistently rising prices will feel like inflation, it is worthwhile to take a closer look. Since early 2002, crude oil has tripled in price from $20 to more than $60 per barrel. While it is obvious that a price increase of that magnitude has a continuing and substantial impact on the economy, the proper perspective is not that rising crude oil causes inflation to rampage throughout the economy. The high price of crude oil should be more clearly viewed as a tax on essential economic elements within our society. This could be more easily visualized if crude oil was still at $20 per barrel, with an additional $40 per barrel of tax imposed by our helpful benefactors and protectors in the Government of OPEC.

Although businesses must raise prices to pass increasing taxes along to the consumer, taxes are not inherently inflationary. Instead of raising the general level of prices throughout the economy, taxes increase the prices of the items taxed and at the same time absorb funds which might have been otherwise used for discretionary purchases. The net result is that taxed items become more expensive, but consumers have fewer funds for other purchases. When consumers will not or can not further increase their debt to continue unessential purchases at the same level as before a tax increase, then the added taxes result in less consumption and a slowing economy.

A tax raises some prices, but depresses others

Higher crude oil prices selectively increase the costs of energy, food, transportation, medical, and many other essential sectors, but at the expense of the consumer having fewer remaining funds for other purchases. Consumers who are near their maximum tolerance for debt will react to higher costs for essential commuting travel to work by making fewer discretionary trips to the mall and by purchasing fewer luxuries. Although travel by automobile is essential in most parts of the USA, consumers stressed by high energy prices will tend to keep their old car longer or to replace it with a used car and to significantly delay the optional purchase of a new car. Everyone needs a place to live, but high energy prices will discourage potential home buyers from looking at new homes with a long commute to the office, and will focus their attention on the positives of renting an apartment closer to work instead. By increasing the prices of essentials, and thereby separating the consumer from a surplus of spending funds, high crude oil prices indirectly reduce the demand for non-essentials such as luxury items, new cars and houses. Just as a tax removes potential spending funds from the economy and transfers those funds to the tax agency, high crude oil prices absorb funds that the consumer would otherwise have available to spend on other purchases.

It should be obvious that a very high tax rate focused on a few essential sectors will depress the overall level of economic activity, and that the slowdown will exert downward pressure on the prices of non-essential sectors. Similarly, high crude oil prices raise the cost of essential transportation, utility, food, and comparable items, but also have a depressing effect on consumers who are left with no surplus of spending funds. The net result is that the prices of essential energy-impacted areas increase, but the slowing economy depresses the prices of non-essential areas.

Inflation adjusted crude oil prices are much higher than average

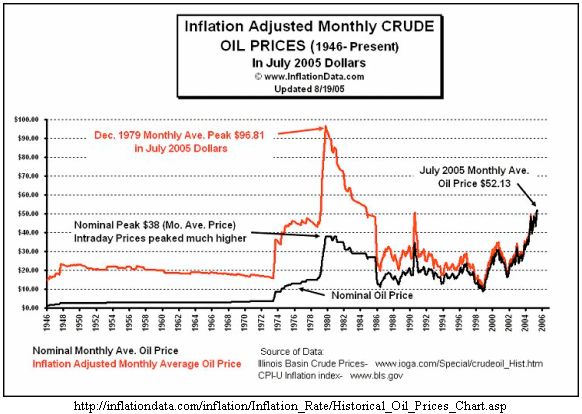

The chart below shows crude oil monthly prices after adjustment for the change in the consumer price index. The time scale is 1946 through July 2005, and the earlier prices are adjusted to the CPI equivalent of July 2005 dollars. The average CPI adjusted price is less than $30 per barrel, and crude oil is now more than double that long term average. Crude oil prices obviously can go higher from this level, but there is also ample room for prices to fall substantially to get back to the long term average.

A slowing economy will moderate energy prices

While pessimists may see a glass full of inflation as the inevitable price increases caused by high energy costs work their way through the economy, the Optimist sees the glass of economic activity being drained dry by high energy costs. As consumers reduce their spending for non-essentials, discretionary sectors will lose jobs, will have falling stock prices, and will be reinforced with an array of negative news. All of those negatives will combine to persuade consumers to reduce unessential spending. The cumulative result of high real oil prices will be an economy which slips and slides toward recession. A slowing economy in the USA will reduce energy consumption both at home and in key Asian nations which will encounter a decrease in the level of their exports to us. A global reduction in the demand for energy will significantly reduce the price of crude oil in international markets. The Optimist is happy he can provide the welcome news that the inflation adjusted price of crude oil will be lower in the future, even if the reason for that good news is a world wide reduction in the rate of energy consumption due to the traumatic recession that high priced energy would impose on the USA.

The Fed will fight the deflation devil

So, do you think that maybe a brief recession would lower energy costs enough to put the USA back on track to a high level of growth and another decade of endlessly rising stock and real estate investments? If so, then you get my vote for the most optimistic person in the nation! As yet another example of This Time It Really Is Different, the Optimist concludes that the USA will not again have another simple recession which proceeds to clean out the excesses of the prior expansion, and sets the stage for solid economic growth in the future. The unimaginable levels of debt and leverage in the USA makes the economy unstable and incapable of supporting the type of normal recessionary slowdown that the nation has gone though so many times before. What would have been a simple and mild slowdown in the past would now be magnified to intense proportions by the debt and leverage. If not given a lifeline, a slowing economy would fall relentlessly into a deflationary depression much deeper than the 1930s.

Fortunately, our friendly Fed is ever alert to that danger, and they keep a lifeline always at the ready. That is the same lifeline which the Fed used to rescue the economy when stocks crashed in 1987, when LTCM defaulted in 1998, in the months preceding Y2K, and when stocks again crashed in March of 2000. That lifeline is a substantial increase in the money supply. So long as the Fed is able to sufficiently ramp up the amount of money in circulation, they can be sure to reverse a potentially disastrous slowdown into a new illusion of growth. That would be a perfect solution for the American economy, except for two small problems. First, the amount of money supply increase needed to positively affect the economy increases with each intervention cycle. Secondly, the liquidity can only be added, but it can never be removed because removing the stimulus of the added money supply would cause the very deflationary depression that the money was injected to prevent. For each crisis that is solved by increasing the money supply, there must be a correspondingly higher inflation caused by an increase in the amount of fiat paper which is chasing the same amount of purchasing opportunities.

Inflation is a rising tide that lifts all price boats

The Optimist argued above that high energy prices, like any other tax, will increase some prices and decrease others. Inflation, in contrast, drives up the prices of everything at the same time. Obviously, some sectors appreciate more rapidly than others, but the great sloshing waves which result from more money supply being pumped into an economic system result in all prices rising from the financial pressure.

No doubt, some alert readers will hasten to observe that crude oil floats on the same rising money supply level, and therefore crude oil prices will also rise with inflation as the money supply is increased. Although it is clearly correct to forecast that inflation will push the ups and downs of crude oil prices into a series of higher highs and higher lows, it is not easy to use that forecast to make investment profits in crude oil now. Even as the low end of the inflation adjusted channel for crude oil prices rises from $20 in 2002 toward $30, the nominal price of crude can drop significantly from current levels if traders see the potential for an economic slowdown.

Silver and gold will prosper as inflation escalates

The investment strategy that is easy to implement is to buy silver and gold at current levels near the bottom (IMHO) of their long term up trend channels. No matter whether crude oil rises more or drops to $30 in a reversion to the mean, the Fed will insure continued inflation to prevent the economy from deteriorating into deflation. Silver and gold will shine as bright as ever in the environment of rising inflation ahead. Those investors who correctly placed bullish bets on crude oil have substantial profits to protect. In addition to congratulating those clear sighted investors, the Optimist respectfully offers the suggestion that they might want to consider capturing some of their profits from crude oil, which is now much higher than its inflation adjusted average, and reallocating a portion of those investments into silver and gold, which will prosper greatly as inflation continues to surge through the economy.

Brian Toews, Toronto, Canada comments (posted 8/25/05):

Interesting Article. The USA consumes 25% of the world's oil. This percentage is decreasing daily. This percentage was much higher previously. Many analysts based in the USA (Robert Prechter as an example) cannot grasp that when 75% of the world's oil supply is consumed outside the USA, the USA no longer determines the price of oil. To take this example to the limit, were the USA to stop consuming oil today and never use another drop, the world oil price would still be far higher 15 years from now. A huge drop in US consumption (10%) is a 2.5% drop in global consumption (which quite likely would be swallowed up by India and China.) Don't hold your breath waiting for the beleagured USA consumer to force down oil prices. This is not 1960. The USA is definitely not determining commodity prices. Look to the east.

the Optimist:

This is a good observation, but the Optimist has a different perspective. Think of the price of crude oil as a train that is being powered uphill ever faster by the massive engines of Asia in addition to the large engine of the USA. In that analogy, the train would continue speeding along even if the output power of one engine was reduced. Consider what would happen, however, if the fuel supply for all the engines was shut off. Although the engines in this illustration are pushing the train ever faster, the fuel for those engines is the rate of economic growth in each area. Throughout Asia, as well as in the USA, the prime constituent of economic growth continues to be consumption by the American consumer. A significant downturn in the American economy will not only reduce the amount of crude oil consumed by debt saturated Americans, but it will also substantially reduce imports from Asia and will slow the economic growth rate there as well. When all the engines are simultaneously running at low power, the speed of the train will slow substantially. Selling short crude oil is not recommended, except perhaps as a novel way to commit financial suicide. However, the Optimist advises caution in any bullish energy positions while crude oil is at more than twice its historical long term inflation adjusted average price. Taking partial profits as crude oil continues to spike up into uncharted territory is a lot better than singing another refrain of the sad song Woulda, Coulda, Shoulda!

A reader comments (posted 8/25/05):

I agree with your assessment. I'm probably one of the few people who picked up a copy of and read" The Economics of inflation-A study of currency depreciation in post-war Germany" by Bresciani-Turroni. I also scanned through and studied parts of "The Great Disorder" by Gerald D Feldman.

One of the main causes of Weimar hyper-inflation was that the new post World War I Reich mark was not a major reserve currency. Also, the new Weimar tried to be all things to all Germans. Additionally, global currency exchanges were relatively new at that time. The combination of excessive internal spending, non major currency status, and a new/wildcatesque currency exchange caused the hyper-inflationary dynamics.

We are not that.

We are a reserve currency. We have stable and transparent currency markets. We may promise all things to all Americans, be we don't necessarily deliver.

And that is what high oil prices really do. It keeps money out of the hands of consumers. It supports the dollar on global exchanges. It stabilizes our debt creation. I guess you could call it "the perfect tax".

Sure, we will see inflation. But I don't think we will see hyper-inflation. We will see "managed" target inflation, and it may get "off the target" sometimes, but it will be manageable. It's not going to be nice, and I think the next Fed chairman (maybe Bernanke- the target inflationist) will have his hands full. But it's survivable, I think/hope.

the Optimist:

Thanks for the historical perspective. It seems that there is a dwindling number of us optimists, so we need to band together. I fully share your optimism for this year, and probably for next year too. In the not too distant future, however, we will need to focus on how to prepare for the coming end game. My guess is that our versions of optimism then may be profoundly different. Best of luck to you as we continue through what we will later describe to our grandkids as the good old days!

Addendum by the Optimist (8/26/05)

Another way to view the difference between the effects of a higher energy tax and inflation caused by increases in the money supply is to revisit the example of crude oil costing its inflation adjusted value of approximately $30, plus an additional tax which is now more than $35 per barrel. A marginal tax rate of $35 for each of the 10 million barrels of crude oil the USA imports each day translates into a tax bill of $350 million per DAY that we pay to OPEC. And you complain about the lousy $50k you pay to the IRS on April 15!! I wanted us to pay the energy taxes to ourselves, so maybe we would get a break from the IRS, but Americans decided to give the millions each day to OPEC instead in exchange for all the wonderful benefits that OPEC provides to us.

The energy tax we pay to OPEC partially explains why CPI increases can be docile while the money supply expands at a high rate. The OPEC tax drains money out of the economy almost as fast as the Fed can pump it in. The Fed giveth, and OPEC taketh away! Unfortunately, the consumer is not one of the beneficiaries in that transaction. Consumers who are already deep in debt are being squeezed much harder by the energy tax we pay to OPEC, and will be forced to reduce consumption. As the pattern of diminished consumption becomes obvious, the weakness in the American economy will reduce imports of unessential items and will slow the growth rates in Asia. The combination of a weak American economy and reduced growth rates in Asia will provide a one-two punch to reduce oil demand and lower the price of crude oil. Even as the price of oil regresses to its mean, the Fed will escalate its growth rate of money supply to counter the slowing American economy. Rising unemployment and rising inflation in the USA will thrust the misery index back into the news each day. To paraphrase GE, stagflation will be our most important product. The only good news the Optimist can offer is that those who bought silver and gold will be well rewarded for having done so. Cheers! Jim

* * * Notice * * *

This commentary presents only the viewpoints of the Optimist, and it is intended only for perspective and entertainment. Please do not interpret any portion of this work as investment advice. If any of the concepts discussed here appeal to you, then you must do the work to decide if and when and how you should invest. The Optimist does not ask for any profits you make, and he cannot be liable for any losses incurred as a result of your investment decisions. The Optimist wishes you the best of luck in whatever you decide to do or not to do. Cheers!

Reader contributions are welcome, and

excerpts will be added to this presentation.

Please send comments or suggestions to the Optimist:

Email: