Rising Open Interest is Bullish for Gold and Silver

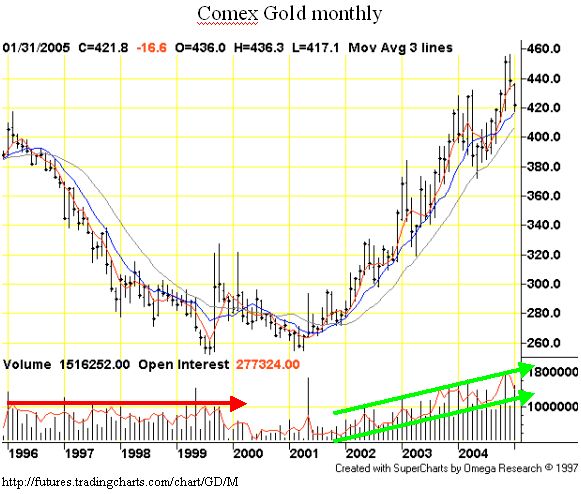

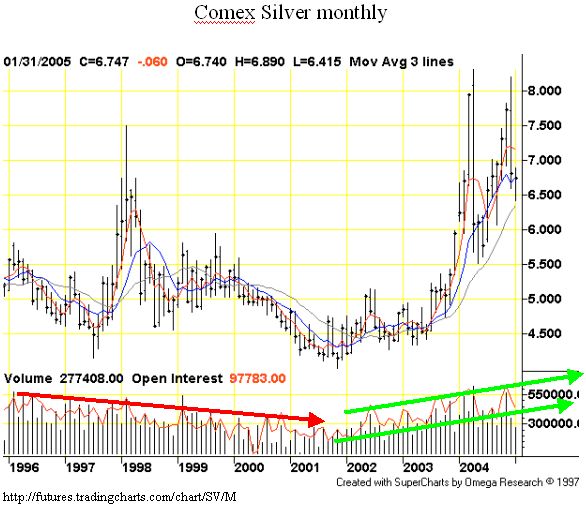

Many editorials have commented on the COT report data to discuss how changes in the open interest of the commercials could impact short term price movements in gold and silver. The Optimist has not yet seen, however, any commentary on the clear long term pattern of rising open interest in the precious metals and in the USDX trade weighted Dollar. Those patterns are immediately obvious when looking at the open interest near the bottom of the three charts presented below.

No doubt, there can be many different opinions about the significance of the rising open interest. Since open interest is composed of an equal number of long and short positions, it might seem plausible to conclude that there are simply more bulls and bears over time. Similarly, one might note that the rising open interest patterns began approximately the same time as gold and silver bottomed and the dollar peaked in 2001. It would be reasonable to conclude that rising open interest is only a reflection of the bull market in the metals. If open interest is only another way to measure rising prices, then it would pose a contrarian bearish note because it would imply that there were many long positions that could be liquidated in a major sell off.

The Optimist, however, sees a strongly bullish interpretation of the long term rise in open interest. Short term traders enter and exit the markets relatively frequently. Although that action contributes to short term volatility, it leaves no significant long term impact on the open interest. As gold declined from more than $400 in 1996 to less than $260 in 1999, there was volatility but no significant net change in the open interest. Even though the market price for gold dropped significantly during those four years, the long term sentiment of bulls and bears was little changed, and so the open interest remained relatively stable. Conversely, the open interest in silver did show a pattern of decline from 1996 to 2000, as the price of silver moved up and down with little net change. The patterns of open interest from 1996 to 2000 show that open interest is not simply another reflection of changes in market price.

The Optimist speculates that the rising open interest in gold and silver since 2001 is a reflection of an increasing number of bulls who are long and strong. The equally rising number of short positions are provided by power players who desire to limit the rise in metals prices. It is immediately obvious that if there had been fewer short positions put into the markets, then the price rise would have been much greater. The strong and consistent price rise over the last four years shows that the bulls are on the winning offense, and the bears are in a losing defensive posture. Another way to view this battle is that it takes an ever increasing number of short positions to limit the gains in gold and silver to "only" 15% per year! The Optimist sees this continuing build-up of both long and short positions as evidence that an increasing number of committed long term bulls are entering additional bullish positions over time.

A sharp spike in open interest could be worrisome, as it might indicate a rapidly rising number of short term speculators had entered the market, so there would be a substantial amount of downside risk as they all tried to liquidate at the same time. The steady rise in open interest over a period of years, however, indicates that bulls are implementing long term commitments to the long side of the markets. Those long term investors have not yet been shaken out of the markets by the sharp but short corrections thus far in this bull market, and the Optimist thinks it likely that the long term bulls will continue to hold and add to their investment positions. The real pressure is on the bears, who have lost huge sums of capital since 2001. As gold and silver resume their climb of the current wall of worry, the long term investors will be aided by the return of bullish short term speculators, and the bears will need to implement a substantial number of additional shorts into an already massive losing position. When the bears can no longer put on enough shorts to suppress the market rise, then we will all see the reason that so many long term investors are so strongly bullish on  Gold and Silver!

Gold and Silver!

* * * Notice * * *

This commentary presents only the viewpoints of the Optimist, and it is intended only for perspective and entertainment. Please do not interpret any portion of this work as investment advice. If any of the concepts discussed here appeal to you, then you must do the work to decide if and when and how you should invest. The Optimist does not ask for any profits you make, and he cannot be liable for any losses incurred as a result of your investment decisions. The Optimist wishes you the best of luck in whatever you decide to do or not to do. Cheers!

Reader contributions are welcome, and

excerpts will be added to this presentation.

Please send comments or suggestions to the Optimist:

Email: