Gold and Silver Equal Dow at 15,000

Published 7/06/05

Two recent forecasts about the price at which gold will equal the DJIA spurred the Optimist's creative nature, and he wants to share the results with you. As background, the inimitable Richard Russell guesses that gold will rise and the Dow will fall so that their price levels will cross in the 2,000 to 3,000 range. The noted Swiss banker Ferdinand Lips also guesses that the Dow and gold prices could cross at 3,000, but he adds that they might cross at 20,000 in an environment of hyperinflation. With all due respect to both of these illustrious gentlemen, the Optimist hopes that they are far too pessimistic. Since the Optimist has chosen the path of perpetual Pollyanna, he feels a solemn duty to offer a much brighter perspective.

* * * Warning * * * Caution * * * Warning * * *

The following is NOT investment advice! The Optimist will be as surprised as everyone else if the projections below approximate the way real events will unfold in the future. This is only an exercise in projecting a possible progression of prices under the stagflation environment which the Optimist supported in  Stock and House Prices Might Not Fall Off a Cliff. Think of this work as entertainment for precious metals bulls, and slow water torture for both bulls and bears on the stock market.

Stock and House Prices Might Not Fall Off a Cliff. Think of this work as entertainment for precious metals bulls, and slow water torture for both bulls and bears on the stock market.

Rationale behind guesses about the future

As indicated in his previous  commentaries, the Optimist believes that the USA economy is currently in a stagflation where prices rise relentlessly, but the nation's employment base is eroding. The economic environment of 2005 is remarkably similar to that of 1975, and the progression of stagflation over the next few years could continue to track the escalating stagflation of 30 years before. In

commentaries, the Optimist believes that the USA economy is currently in a stagflation where prices rise relentlessly, but the nation's employment base is eroding. The economic environment of 2005 is remarkably similar to that of 1975, and the progression of stagflation over the next few years could continue to track the escalating stagflation of 30 years before. In  This Time, It Really Is Different!, the Optimist argued that the Fed will be constrained from using the high real interest rate approach it took to stop rising stagflation in 1980. The logical conclusion is that stagflation will continue to increase at ever higher rates for the next decade or more. While the possibility always exists of an abrupt encounter with a massive iceberg as the good ship USS Economy sails through stormy seas, such an event is unpredictable and the results from a collision are far from certain. This commentary will assume that there is no cataclysmic financial accident in the next decade, and that the USS Economy will continue uninterrupted in its course through ever worsening rough seas.

This Time, It Really Is Different!, the Optimist argued that the Fed will be constrained from using the high real interest rate approach it took to stop rising stagflation in 1980. The logical conclusion is that stagflation will continue to increase at ever higher rates for the next decade or more. While the possibility always exists of an abrupt encounter with a massive iceberg as the good ship USS Economy sails through stormy seas, such an event is unpredictable and the results from a collision are far from certain. This commentary will assume that there is no cataclysmic financial accident in the next decade, and that the USS Economy will continue uninterrupted in its course through ever worsening rough seas.

A brief note about inflation is in order before the projected data is presented. As discussed in  $100 Oil Solves the Wrong Problem, the Fed has a strong arsenal of weapons it can use to moderate the rises reported in the official CPI. The Optimist is happy that he can offer the positive perspective that the CPI data from Washington will show inflation increases at less than double digit levels through the next decade. For the purposes of this essay, however, the Optimist includes the likely impact of much higher prices of food and energy as if they were real issues that actually affect people's finances, and he ignores the abundance of hedonic opportunities which the Fed can employ so well. Thus, the Optimist's guesses about the level of inflation reflect the real cost impact that he anticipates consumers could feel in their wallets.

$100 Oil Solves the Wrong Problem, the Fed has a strong arsenal of weapons it can use to moderate the rises reported in the official CPI. The Optimist is happy that he can offer the positive perspective that the CPI data from Washington will show inflation increases at less than double digit levels through the next decade. For the purposes of this essay, however, the Optimist includes the likely impact of much higher prices of food and energy as if they were real issues that actually affect people's finances, and he ignores the abundance of hedonic opportunities which the Fed can employ so well. Thus, the Optimist's guesses about the level of inflation reflect the real cost impact that he anticipates consumers could feel in their wallets.

The Optimist's guesses about future highs

The format of the data

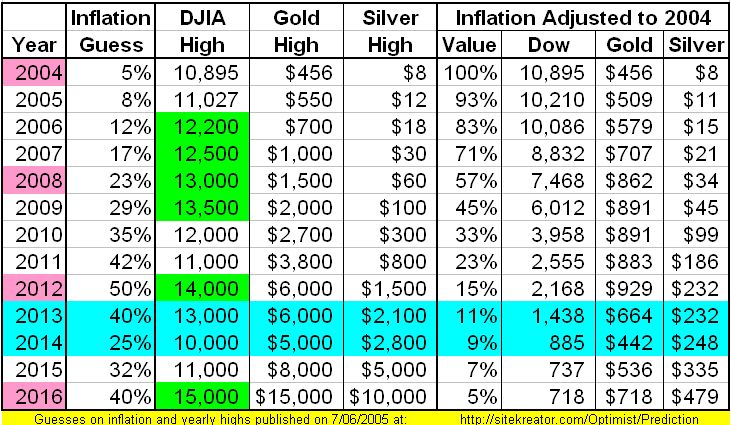

Even though everyone knows that the Fed controls the economy, and the Fed is an independent organization, the Optimist highlights the presidential election years in light red as if politics had some bearing on prices and performance of the markets. Even the Optimist cannot pretend there will be no more recessions, so he colors in light blue a possible recession, coincidentally beginning immediately after the 2012 presidential election. With the rest of the data on a white background, the Optimist is pleased to show his patriotic fervor by presenting the data in shades of red, white, and blue! The one exception is that the Optimist cannot conceal his joy at identifying no less than six new annual highs in the Dow through 2016, and he highlights those highs with bright green. With wildly bullish guesses of six new stock market highs in a decade, it is easy to see how the Optimist earned his name!

The columns to the right of the projected market highs show values relative to 2004 after adjustment for subsequent inflation. The Value column demonstrates the miracle of compounding by showing the value that remains after the annual inflation.

Inflation

Stagflation presupposes significant levels of inflation, and the Optimist is happy to comply with those rules. Although his guesses for inflation are consistently higher than the levels our economy has previously experienced, they are still moderate in comparison to some who suggest that hyperinflation is a prospect in the not too distant future. A quick search of the internet shows that hyperinflation can get as high as hundreds of per cent per day. The Optimist is hopeful that we will not visit those elevated levels of hyperinflation for many years. The Optimist also forecasts a 50% reduction in the rate of inflation during a recession in 2013 - 2014. The Optimist is happy he can show his support for the Fed as they do battle with real inflation after the 2012 elections.

Stock Market

The Optimist is very confident that his projections for the highs in stocks, gold and silver for 2004 will be proven to be approximately correct, but he is less certain about the indicated highs for 2005. After that, his crystal ball is temporarily not working well so subsequent highs are really only guesses to illustrate the trends he considers possible. The Optimist believes that a sharp drop in the stock market is not politically correct, but that reduced profit levels and the stagnation in the economy will make substantial price advances unlikely too. Although a real effort to constrain inflation could temporarily lower stock prices by a third as indicated in the recession of 2013 - 2014, the Optimist concludes that stocks which are not permitted to decline will repeatedly rise to new highs over the next decade. That would obviously be bad news for the bears, but the bulls who cast an eye on their value adjusted returns may also be less than overjoyed. During consistently rising inflation, the stock market might not be the best sandbox for kids to play in.

Gold

Even though the Optimist has learned through experience that making predictions is a humbling process, he boldly offers his view of how the price of gold might progress during high and rising inflation. Time will tell whether this boldness is a reflection more of confidence in his viewpoint or of his inability to learn from his past errors.

As clearly demonstrated in the 1970s, gold responds enthusiastically to rising inflation in a stagflation environment. In many places and over a multitude of centuries, gold has proven its ability to retain value as fiat currencies deteriorate over time. Owning gold has long been considered as the ultimate insurance policy against problems caused by escalating inflation. While it is true that gold pays no interest, we learned in the 1970s that earning a few percent interest was little consolation as real inflation decimated a higher percentage of the investment.

At first glance, all readers will consider the guesses for the prices of gold to be outrageously high. A second look at the inflation adjusted values will provide a more sobering viewpoint. After gold values escalate with the price momentum over the next few years, the recession of 2013 - 2014 could return the inflation adjusted value of gold to a level below its highs in 2004. The questionable assumption in this data is how high the real rates of inflation will be over the next decade. If the indicated guesses for real inflation are close to reality, then gold prices really can advance as rapidly as shown.

Silver

Silver is an intriguing metal. It has so many uses that it is being consumed by industry at a faster rate than it can be mined from the ground and recycled from previous uses. Although there were billions of ounces of bullion silver in government warehouses just a few decades ago, those warehouses are now empty. It seems likely that there exists less than a few hundred million ounces of bullion silver remaining in other warehouse stocks to be consumed at the lowest cost for silver. As those stocks become more depleted, the value of silver must rise to give private holders of bullion, coins and jewelry an incentive to feed their silver into the industrial silver consumption machine. In addition to the value which must be added for depletion of supply, silver prices will also respond aggressively to the price pressures generated by rising inflation.

An interesting sidebar is that the table shows both nominal prices and real adjusted values of silver to continue rising through the projected recession of 2013 - 2014, even though demand for silver would likely slow somewhat during a recession. That price advance would occur because much of silver's production is a byproduct of copper and zinc mining. In a recession, the prices of copper and zinc could drop close to or even below the cost of mining, so the mine output would be substantially reduced. That in turn would also reduce the amount of byproduct silver which is dumped on the market. Total silver supply would decrease faster than demand would drop, and so a recession would actually increase the price pressure on silver.

Another point to consider is that silver is actually being consumed by industrial processes around the world at a faster rate than it can be mined from the earth, so the above ground total supply of silver diminishes daily. Gold, in contrast, has less destructive consumption, so most of the newly mined gold adds to the above ground supply in the forms of bullion, collectibles, jewelry, etc. If that trend continues, silver will be less plentiful than gold. The combination of relative scarcity and industrial demand pushed platinum to much higher prices than gold, and it can do the same for silver.

As a final note on silver, this hypothetical set of price and value trends does not try to forecast the dislocations that are inevitable when manufacturers who need silver panic to buy the limited supply, or when the commercial interests who are massively short silver futures and options are finally forced to cover their short positions. Each of those events could rocket silver prices higher by orders of magnitude, and stair step the progression shown in the table to much higher price levels. Once again, the Optimist demonstrates his perpetually positive nature by cheerfully forecasting that silver could be more expensive than gold when the price of gold rises higher than the DJIA in the years ahead.

Housing and interest rates

Conspicuous by omission are forecasts for housing and interest rates. They are not in the table because the Optimist does not want to waste readers' time with random thoughts that he has no strong basis for discussing. Some readers will inevitably ask about those important topics, however, so the Optimist will close this commentary with ballpark guesses. The current average cost of the typical suburban house can be estimated to be twenty times the DJIA. Even though real estate is currently over priced and in a bubble, it is likely to outperform stocks in an environment of high and rising inflation. That same typical house could rise to a higher multiple of the DJIA over the next 12 years. Even considering the possible rise compared to the DJIA, fewer ounces of gold or silver will be needed to purchase in 2016 the equivalent of a house which now costs 500 ounces of gold. A word of caution is necessary for any reader who dreams of buying a bunch of houses at no money down to capture some of the increase in equity. First, the Optimist could be wrong (it would not be the first time!), and house prices may not rise. Second, many undercapitalized buyers will find they cannot survive the crunch caused by rising demands for cash flow, and they will be forced to sell at a loss. Third, rising unemployment will cast a pall over the housing market, and there is likely to be a shortage of greater fools to fulfill their destiny as buyers when the owner needs to sell his house.

The Optimist confesses to profuse confusion over the current low and falling long term interest rates. In the 1970s, few things were more certain than that long bond rates would climb higher each time that inflation growled louder. Now, it seems like long term interest rates drop each time real inflation pushes prices higher. If that strange trend continues, one wonders if long term interest rates could drop toward zero when inflation rises in double digits! Once again, the Optimist cautions trusting readers to not use this viewpoint as investment advice!!

A reader comments (posted on 7/10/05):

Allow me to provide a rosy outlook for long bond holders. [I suspect that, like US stocks, US bonds are not permitted to fall in price.] Should Asian Central Banks cease their purchases of US bonds, the US Federal Reserve

will be happy to fulfill its obligation as "lender of last resort" (to the Government, silly, not you) by buying all bonds the US Government cannot foist on anyone else. [Indeed I'm pleased to declare that this is already happening, witness this chart of Federal Reserve treasury holdings:  http://www.gold-eagle.com/editorials_05/images/hathaway070105f.gif (from this article

http://www.gold-eagle.com/editorials_05/images/hathaway070105f.gif (from this article  http://www.gold-eagle.com/editorials_05/hathaway070105.html which notes that foreign CBs were net sellers in March & April).] Since vigorous buying of bonds by foreign and then domestic CBs drives long bond prices up and yields down, and will continue to do so throughout the rising tide of US "liquidity", I see no reason to fear that long-term interest rates will go up ever again.

http://www.gold-eagle.com/editorials_05/hathaway070105.html which notes that foreign CBs were net sellers in March & April).] Since vigorous buying of bonds by foreign and then domestic CBs drives long bond prices up and yields down, and will continue to do so throughout the rising tide of US "liquidity", I see no reason to fear that long-term interest rates will go up ever again.

The US Federal Reserve may end up having to own all outstanding bonds. In those future mightily-replicated and -devalued dollars the bonds will actually be worth a few pennies. But, after a century of us all being obliged to pay interest to the Federal Reserve for borrowing money it could mass-produce for pennies, it is only fitting that the US Federal Reserve should sink under its own "liquidity", and sink with the Government it pretends to be, and end up once again owning only some pennies. So I view this outcome as miraculous poetic justice.

A reader comments (posted on 7/20/05):

I manufacture Electronics. Here in Europe we have something called the RoHS directive. The directive requires that end-customer electronics for Europe should be manufactured using lead-free solder. Referring to your estimation on a significant higher price for Silver, I note that most lead-free solders currently include approximately 3.5% of Silver. I don't know how much Silver would be needed to cover the fraction of solder that will be used in lead-free production. But it could end up to an extra demand of 200 to 600 metric tons annually. That could be about 2% of world Silver production. Sorry, I don't know much on the Silver market, so I can not say if 2% is the correct number, or if it is a large or a small number!

The Optimist:

Many thanks for a most interesting data point. It seems like the uses for silver expand almost daily, and the amount of silver available to satisfy the demand continues to dwindle. Unless some bright alchemist can quickly develop a way transmute lead into silver, a silver price explosion is inevitable, and it is likely to be sooner rather than later. For readers who are not well aware of the awesomely bullish state of the silver market, I recommend reading all of the  articles written by Ted Butler. Of special note is the

articles written by Ted Butler. Of special note is the  July 12, 2005 article titled You DO The Math in which Mr. Butler clearly stated that there is already less silver in the world than there is gold. An equation in which there is less silver than gold, raised to the power of silver being consumed rapidly by industry, can only yield the result of much higher silver prices in the future.

July 12, 2005 article titled You DO The Math in which Mr. Butler clearly stated that there is already less silver in the world than there is gold. An equation in which there is less silver than gold, raised to the power of silver being consumed rapidly by industry, can only yield the result of much higher silver prices in the future.

* * * Notice * * *

This commentary presents only the viewpoints of the Optimist, and it is intended only for perspective and entertainment. Please do not interpret any portion of this work as investment advice. If any of the concepts discussed here appeal to you, then you must do the work to decide if and when and how you should invest. The Optimist does not ask for any profits you make, and he cannot be liable for any losses incurred as a result of your investment decisions. The Optimist wishes you the best of luck in whatever you decide to do or not to do. Cheers!

Reader contributions are welcome, and

excerpts will be added to this presentation.

Please send comments or suggestions to the Optimist:

Email: