Real Interest Rates Control Gold & Silver

Published 6/13/05

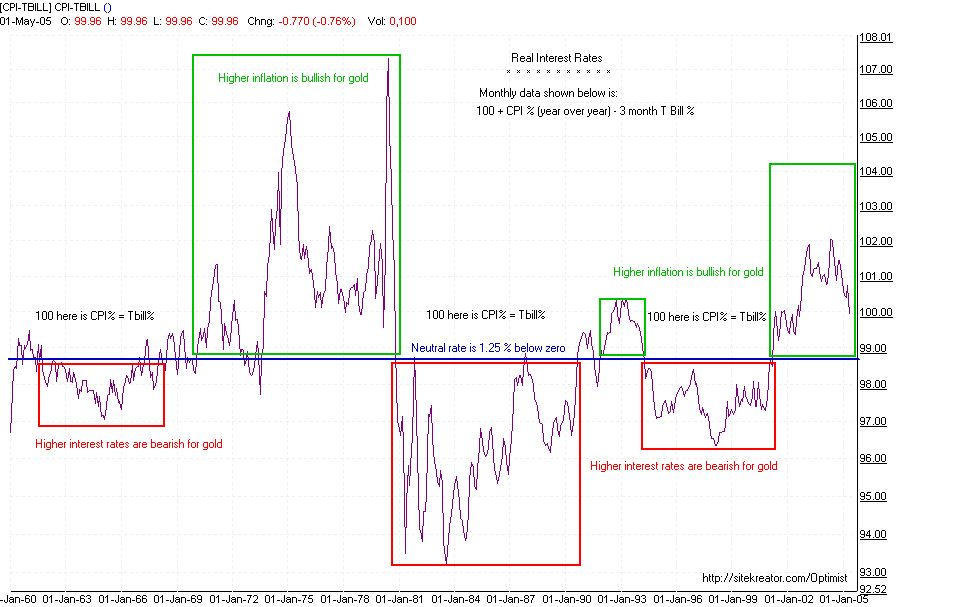

The investment climate for precious metals gets hot (bullish) or cold (bearish) depending on the relationship between interest rates and the rate of inflation. When interest rates are low and the fires of inflation are burning bright, then gold and silver will be in a strongly bullish mode. Conversely, when the FED raises interest rates sufficiently high to dampen inflation, then gold and silver prices will descend in a bearish mode.

The chart below shows the monthly data since January 1960 for inflation (CPI, year over year) minus interest rates (3 month T Bills). As indicated in  This Time It Really Is Different, the neutral point is not when inflation equals interest rates, but is approximately 1.25% less than zero difference. That offset is due to the interest rate that would exist even if inflation could be magically locked at zero. In the chart below, the zero difference level has been moved to 100, and the neutral rate is illustrated by a blue line at 98.75 %. When the difference between inflation and interest rates is higher than the blue line, precious metals chart a bullish path. When the difference between inflation and interest rates is below the blue line, precious metals endure extended bearish corrections.

This Time It Really Is Different, the neutral point is not when inflation equals interest rates, but is approximately 1.25% less than zero difference. That offset is due to the interest rate that would exist even if inflation could be magically locked at zero. In the chart below, the zero difference level has been moved to 100, and the neutral rate is illustrated by a blue line at 98.75 %. When the difference between inflation and interest rates is higher than the blue line, precious metals chart a bullish path. When the difference between inflation and interest rates is below the blue line, precious metals endure extended bearish corrections.

Since 2001, inflation is significantly higher than interest rates, and the Optimist is happy to report that the current environment for precious metals is solidly bullish.

Note: The Optimist considers it likely that the official CPI does not properly reflect the true level of consumer prices and changes in the CPI do not show the real rate of inflation. Rather than publish a chart based on fictional data, the Optimist intends to not update this chart data.

* * * Notice * * *

This commentary presents only the viewpoints of the Optimist, and it is intended only for perspective and entertainment. Please do not interpret any portion of this work as investment advice. If any of the concepts discussed here appeal to you, then you must do the work to decide if and when and how you should invest. The Optimist does not ask for any profits you make, and he cannot be liable for any losses incurred as a result of your investment decisions. The Optimist wishes you the best of luck in whatever you decide to do or not to do. Cheers!

Reader contributions are welcome, and

excerpts will be added to this presentation.

Please send comments or suggestions to the Optimist:

Email: