Viewpoints

* * * Notice * * *

This commentary presents only the viewpoints of the Optimist, and it is intended only for perspective and entertainment. Please do not interpret any portion of this work as investment advice. If any of the concepts discussed here appeal to you, then you must do the work to decide if and when and how you should invest. The Optimist does not ask for any profits you make, and he cannot be liable for any losses incurred as a result of your investment decisions. The Optimist wishes you the best of luck in whatever you decide to do or not to do.

My gold target for taking partial profits

(posted 8/03/2019)My channel lines on the updated chart of the MoreAu Index below project a gold price of $1,530, more (if the USDX drops) or less (if the USDX increases). That is my approximate target for taking partial profits from the current bull move. YMMV so DYODD!

Note that the MoreAu Index shows the value of gold, which is almost as high as it was in 2011. The price of gold was higher then because the USDX was substantially lower than today.

Gold price breakout!

(posted 6/22/2019)

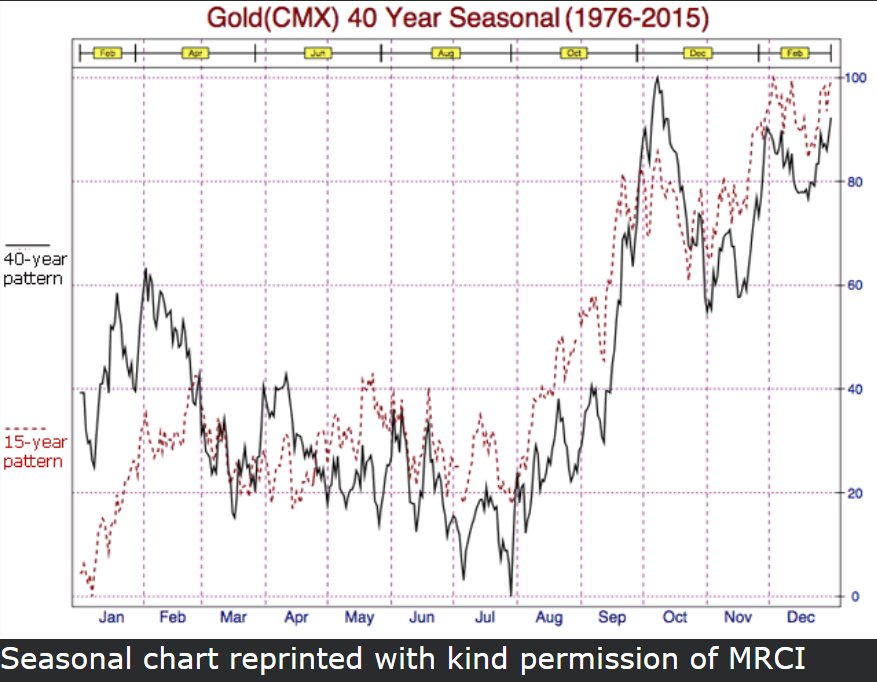

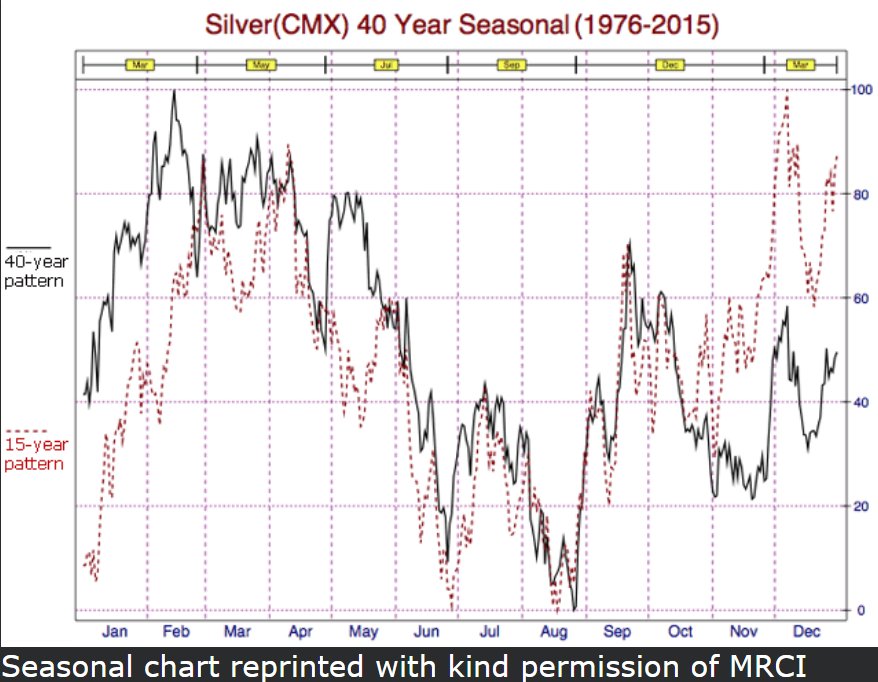

Gold had a stellar week, with a strong breakout above the 5 year price ceiling enforced by TPTB, but not all of us precious metals "bugs" are smiling. Mia culpa, I sold a small portion of my metals mining stock in March to raise cash intended for repurchase in mid to late July. Although most of my portfolio is strongly higher, the stock I sold would also be higher if I did not sell it. The reason I sold in March planning to buy more in July is illustrated in the 40 year seasonal charts copied below. Precious metals prices have a long history of drooping during the summer doldrums, from spring until August when the strongest price rise of the year begins. It is anybody's guess what prices will do this year, but I continue to hope that I will be able to buy more metals mining stock in July than I sold in March. YMMV so DYODD.

http://www.321gold.com/charts/seasonal_gold.html

http://www.321gold.com/charts/seasonal_gold.html

http://www.321gold.com/charts/seasonal_silver.html

http://www.321gold.com/charts/seasonal_silver.html

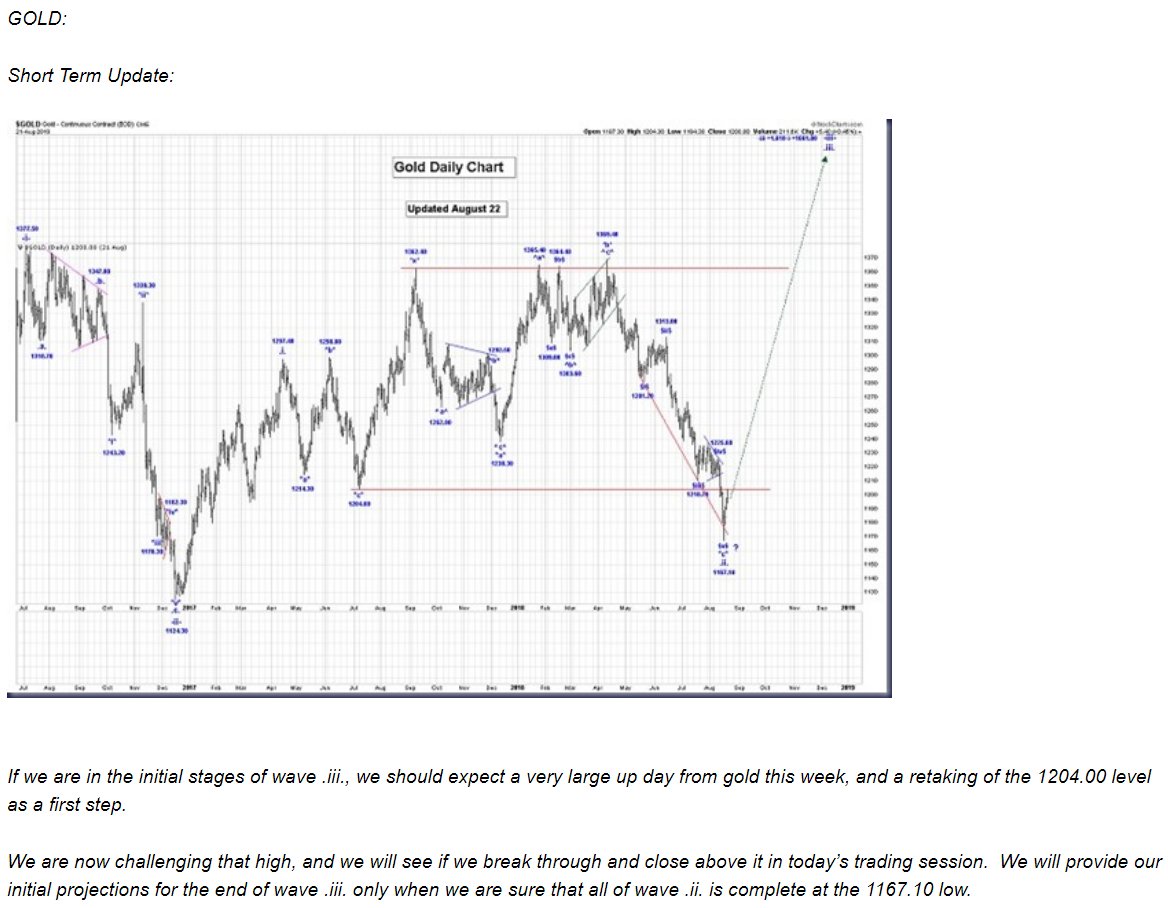

A rally in 4th quarter 2018?

(posted 8/24/2018)Surprised, I am, by the sharp drop in metals prices over the past few months but hopeful, I continue to be, that other nations with deep pockets (China, Russia, India, etc.) will step up to take delivery in December, and burn multitudes of shorts in the process. The article below is music to my ears. It is long overdue for a substantial rally into the end of year, just like the metals did in 2001, 2003, 2005, 2007, and 2010. YMMV so DYODD.

Source: https://www.jsmineset.com/2018/08/23/jims-mailbox-2226/

What's in store for 2018?

(posted 1/02/2018)My guess is that the seasonals and alternate year bull cycles (like in 2001, 2003, 2005, 2007, and 2009-2011) will return after being suppressed for 7 years. That implies a strong rise into March or early April with silver climbing to $21-22. Then silver could drop back to approximately $16-17 by July or August for the typical seasonal summer doldrums. That would be another great buying opportunity since silver could approach $30 by the following March. Gold will boldly ride on the same train as silver, but in the caboose as the gold-silver ratio descends back to reality. DYODD, and don't bet much on my guesses!

Reply to excellent articles

(posted 12/02/2017) Excellent articles! It is worth recalling that gold and silver had substantial rallies in 2001, 2003, 2005, 2007, and 2009-2011. Each rally was stronger than the ones that preceded it. It now seems clear that the FED and its bankster attack dogs decided to break that escalating pattern in 2011 by not only pressing gold and silver down, but holding it down to quench bullish enthusiasm. "FED & friends" obviously have the ability to drive metals prices lower, but they have chosen to not do that. My guess is that they want to limit price advances (to minimize the risk of starting another "gold rush"), but also keep prices high enough to discourage physical accumulation. The mystery here is how long can they keep this juggling act going, in addition to fighting all the other financial fires in the world.

Excellent articles! It is worth recalling that gold and silver had substantial rallies in 2001, 2003, 2005, 2007, and 2009-2011. Each rally was stronger than the ones that preceded it. It now seems clear that the FED and its bankster attack dogs decided to break that escalating pattern in 2011 by not only pressing gold and silver down, but holding it down to quench bullish enthusiasm. "FED & friends" obviously have the ability to drive metals prices lower, but they have chosen to not do that. My guess is that they want to limit price advances (to minimize the risk of starting another "gold rush"), but also keep prices high enough to discourage physical accumulation. The mystery here is how long can they keep this juggling act going, in addition to fighting all the other financial fires in the world.

I hope that a future article will focus primarily on silver. There is enough gold bullion available to allow China and Russia to continue their rate of accumulation for some time, but there is barely enough silver bullion available for industrial consumption. My guess is that the FED is more concerned about the price of silver (than gold) rising high enough to start another stampede because a rapidly rising price of silver could trigger an explosion in demand for physical silver that would be impossible to contain. My view is that the FED needs to apply more force to quench potential silver rallies than it applies to gold, because a surge in demand for the low supply of silver could break the COMEX, and begin a process that puts the financial system of the West at risk. Cheers! Jim (aka Optimist)

(posted 12/17/2016)

Keep the Electoral College, but eliminate EC voters

Are you ready for the 2016 election to decide the next President of the USA? Some people think that election was already held in November, but they are mistaken. The nationwide vote in November only selected the electors in each state. The electors will actually decide the next President when they vote Monday 12/19, though the final result will not be known until January 6.

The electors selected by each state are supposed to vote the way the voters in their state wanted them too. In the past month, however, there has been an unprecedented effort to convince, or force, electors to vote opposite the way the state voters wanted. Electors have been threatened, cajoled, besieged, and offered bribes to change the votes they are supposed to make. None of that should happen, because electors should vote in line with the voters in their state.

The supporters of the losers in the election are demanding that the electoral college provisions be removed from the Constitution, so that the voters would then decide the election in November. That is a bad idea because then the massive number of votes (including fraud) in the big cities would overwhelm the less densely populated states. The Founding Fathers brilliantly chose the electoral college as a way to preserve the integrity of all voters.

A change in the Constitution is a good idea, but not to eliminate the electoral college. Instead, the change should be to eliminate the electors, and have the electoral votes for each state decided automatically after the November election. There is no good reason for states to appoint electors, and then worry that the electors might vote in the opposite way that the state voters wanted. There is also no good reason to put electors in the unenviable position of being threatened or offered bribes to change their vote. The electoral college is a good way to elect the President, but removing people from the elector process and assigning the electoral college votes automatically in each state based on the way the voters in each state voted would make a substantial improvement in the USA Presidential election process.

Understanding Elections, Gold & The US Dollar Via Market Manipulation

(posted 11/25/2016)Avery Goodman posted an excellent article  at this link with the above title. He offers too much to quote here, but I will excerpt a point he makes early in the article:

at this link with the above title. He offers too much to quote here, but I will excerpt a point he makes early in the article:

Forget about the money supply, market sentiment, exchange rates, inflation, and inflationary expectations. Forget about the quaint notion that supply vs. demand (in the short to medium run) has anything to do with the price of gold. Most importantly, forget about technical analysis. Fibonacci is as worthless as an Elliott wave when the manipulators paint the tape. It’s all rubbish.

The pricing factors I’ve just rattled off, in the preceding paragraph, do affect gold prices at specific points of time. But, in determining the near-term price of gold, they pale to insignificance compared to market manipulation.

My viewpoint corresponds closely to the above comment, and it helps to explain why the Optimist charts minimize the "noise" contributed by technical analysis. Instead, my charts focus on projected manipulation timing and relative price lows and highs to find buy and sell zones.

I also recommend reading the comments section in Avery's article. I added my own comments, which I repeat below:

Thanks!! I am happy to see your confirmation of my view that chart technicals matter only if the Banksters decide to use them as cover for their price manipulation. I focus on Jim Sinclair’s trading approach, loosely paraphrased as sell (a little) when prices are rocketing higher (like a rhino horn pointed up) and buy a lot when prices drop fast (like the fishing pole line when fishing down off a pier). I also temper that approach by looking for highs near the third week of each month before gold or silver delivery (before the Bankster bash preceding options expiration), and for lows the end of those months (or a few days later after the Bankster purge into notices to take delivery).

Your article focuses on gold and the probable supply by the FED and Treasury to the Banksters. You may also want to comment on silver, which no longer has any significant source of supply other than the unlimited dumping of paper contracts by the Banksters. My guess is that Russia and China are well aware that the Banksters naked paper shorts are very vulnerable to a short squeeze, but are not doing that because they can continue to add to their gold holdings at a low cost. When Russia and China decide they have enough gold and want to end the game, they need only to reallocate their physical purchases from gold to silver. The resulting Bankster implosion would bring down the entire financial network of the West.

An Open Letter to Mining Company Executives

(posted 11/14/2014)Please accept my sincere condolences on the continuing suppression of metal prices. As a stock holder in your company, I share your concern that an unrelenting environment of depressed metal prices will inevitably cause damage to your mining company. I will not insult your intelligence by dwelling on the long term solution that you are so very well aware of (i.e., reduce mining output at low prices, both as a way to pressure prices higher, and as a way to conserve your precious in ground resource for times when prices are more favorable). Instead, I hope to suggest short term tactics that could help to restore higher prices.

A physical solution to a paper problem

You do not need me to tell you how intensely painful it is when a few traders dump a huge amount of paper metal short sales into the futures market, frequently at times when there is little volume, so the paper dump results in maximum price reduction. When the objective of those traders is to reduce the price, their dumping approach is certain to work. No doubt, those traders expect to make profits by being allowed to buy back their short positions at lower prices as longs panic and sell at a loss. That dumping plan by traders who have essentially unlimited resources to sell huge quantities of paper futures contracts would be an invincible way to make immense profits, except for a small detail. The futures contracts they sell in huge numbers require delivery of real physical metal if they are not closed out prior to the delivery time. Mining executives can exploit that weakness by refusing to sell discretionary physical metal during the month or so before delivery notices are issued. For example, miners could withhold from the markets all physical metal that they have timing discretion over until after the delivery notices are issued. By withholding discretionary sales during the month before delivery notices are issued, and by telling potential buyers for the following month to take delivery of futures contracts instead, mining companies could transform the earlier losses (caused by dumping huge amounts of paper futures) into gains as the traders who were betting they could sell short and then cover later are forced to buy at increasing prices because they do not have the metal required for delivery. Then the miners could sell into higher prices (after delivery notices have been acted on) the physical product they withheld from the market over the previous month. By focusing on withholding physical sales during the month before delivery, mining executives can press the short traders by constricting their supply of metal to deliver while encouraging buyers to take delivery from the futures exchange. Note that this approach only considers discretionary sales. Sales required by contract should be completed as previously agreed. When negotiating contracts or extensions for the future, however, mining company executives may want to consider time windows in which they retain flexibility about when they are required to deliver product.

Dividends payable in physical

Another approach that could be used by mining companies who pay dividends to shareholders is to offer the stock holder an option to receive dividends in the form of physical bars or coins made from the metal the mining company produces. That would increase the price of the stock in two ways. First, more shareholders would buy the stock specifically for the opportunity to receive real metal as dividends, especially if the cost of that metal was near the wholesale cost of the metal produced by the mining company. Second, bears who sell the stock short would need to obtain the appropriate physical metal needed to match the dividend those short sellers would be obligated to pay.

Dividends delayed

If metal prices drop below the actual cost of production, then the mining companies that pay a dividend could stop that payment, and divert the funds into buying futures for delivery. By taking delivery of very low cost metal from the futures exchange, mining companies would make it more risky for traders to bet short on the metals, and would increase the value of the company for shareholders.

Share information with shareholders

Mining company executives are encouraged to share information about their tactics with their shareholders, either by email or prominent notices on the company web page. There is no need for one company to try to influence the actions of another company. Other mining companies will learn about the tactics that executives tell to their shareholders, and then the other mining companies can decide for themselves if they want to do something comparable. Hopefully, it is not yet illegal for mining companies to decide when to sell their product, and to communicate information with their shareholders. However, if any portion of this open letter contains anything that borders on anything illegal, then all readers are encouraged to ignore that portion. Readers may want to forward the legal portions of this message to their favorite metal mining company. With enough focus on delivery of physical, we may be able to loosen the death grip a few very large traders have on the metals markets.

Physical silver rocks will beat paper silver when . . . (posted 11/06/2014)

Quarantine all who leave West Africa (posted 10/26/2014)

Should health care workers who treat Ebola in Africa be quarantined?

Should health care workers who treat Ebola in Africa be quarantined?I have a different view. I think everyone* who travels from a region where Ebola is a serious problem must be quarantined for 21 days at their first stop outside that region. Countries that allow air traffic from Ebola infected regions should create "Ebola Hotels" in which each person (or family traveling together) would be in forced into quarantine isolation for 21 days, or until tests can conclusively prove that the person is free from Ebola.

The costs of the Ebola Hotels and for holding each person in isolation should be shared by the person, the receiving nation, and the United Nations. Aside from the obvious health risks that people pose when they were in an Ebola infected region, each traveler from those regions also carries a huge financial liability for treating any victims they infect and for preventing the disease from spreading through the nation they travel too. The costs to contain and treat the new victims can exceed hundreds of thousands of dollars, and those costs should not be forced onto the receiving nations. Anyone who cannot afford their share of the potential costs related to Ebola treatment should not be allowed to fly out of a region that is infected with Ebola, and thereby transfer the related health and financial risks to the new nation they want to travel too.

On 26 August 1976, a second outbreak of EVD began in Yambuku, Zaire . . . Soon after Lokela's death, others who had been in contact with him also died, and people in the village of Yambuku began to panic. This led the country's Minister of Health along with Zaire President Mobutu Sese Seko to declare the entire region, including Yambuku and the country's capital, Kinshasa, a quarantine zone. No one was permitted to enter or leave the area, with roads, waterways, and airfields placed under martial law.http://en.wikipedia.org/wiki/Ebola_virus_disease

For an unknown reason, however, TPTB refuse to isolate the West African countries that are infected with Ebola, and they continue to permit people to leave the infected areas. Since people will be allowed to leave West Africa, it is essential that the nations that are willing to accept them share in the costs to prevent Ebola from spreading outside the infected region. Quarantine in Ebola hotels at the first point of arrival from West Africa seems like the best way to do that. Trying to quarantine travelers inside West Africa before they get on a plane would be a hopeless task. There are essentially no facilities there that could reliably do the job, and few treatment facilities not already overwhelmed with other Ebola patients that could help anyone who did have Ebola.

Why worry about bullion silver?

(posted 10/17/2014)The silver byproduct effect and future impact (posted 10/09/2014)

Another poster was beating his new drum again about how byproduct silver will depress the price of silver for decades to come. I felt compelled to respond:

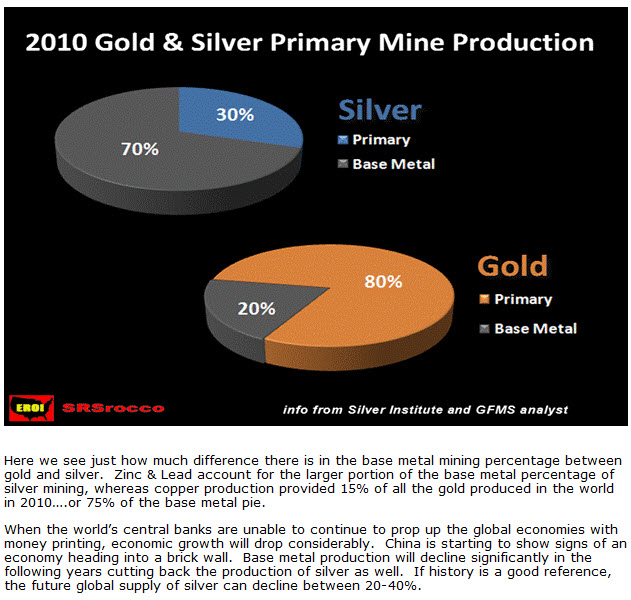

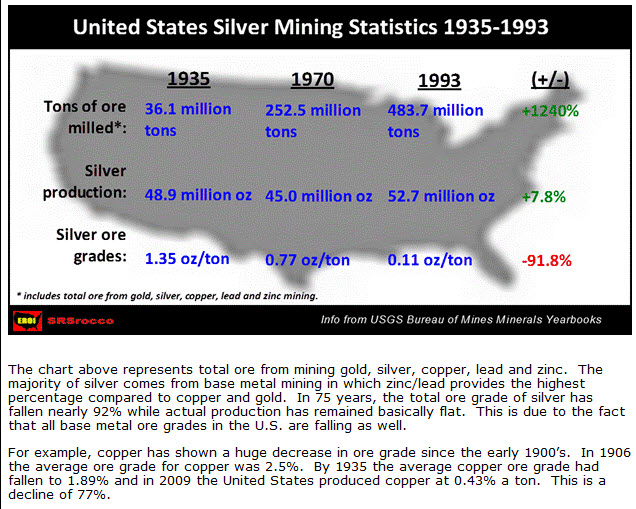

I have heard the repetitive noise your new drum makes, but it is not music to my ears. The byproduct factor in silver is not new. It was noted by many people even before it was prominently discussed in September 2005 (When Will the Price of Silver Explode?). I mentioned the byproduct situation several times over the past few years, because I see it as a huge positive for the very high price that silver could explode to when a slowing world economy forces base metal miners to reduce their mining output. It is the silver produced as a byproduct that prevents a silver shortage from being obvious. I expect an explosive price rise when the amount of that byproduct is reduced and the veil of just in time supply of byproduct physical silver is lifted from the eyes of industries that consume silver, as well as from investors who do not yet see the delivery problems that will become obvious to all in the future.

Sorry, but that dog does not hunt. During the decade from 2000 to 2010, third world nations (China, India, Mexico, and others) were massively building their production industries in an effort to ramp up their economies. That rapid buildup created an immense demand for base metals, and the base metal miners responded by substantially escalating their mining output, including the amount of byproduct silver they dumped onto the market. So how did all of that byproduct silver affect the price of silver during the decade? The price increased from approximately $4.30 in 2003 to $8 in 2004, from $6.60 in 2005 to $14.30 in 2006 to $21.40 in 2008, and from $8.40 in 2008 to almost $50 in 2011. Those price increases were all during the unprecedented industrial buildup in several nations. That buildup consumed huge amounts of base metals, so the miners also generated massive amounts of byproduct silver. Fast forward to now. With the world economies slowing under heavy debt loads, and with the industrial growth rate in China and other emerging nations slowing to much smaller increases, the now mature emerging market industries do not have the rapid growth pattern that marked the decade of 2000-2010. Reduced growth rates directly diminish the demand for base metals, and base metal prices are lower as a result. It is only a matter of time until base metal miners cut back further on their production, and that will also reduce the amount of byproduct silver produced. Meanwhile, silver consumption continues to rise as the newly affluent workers in the emerging nations improve their lifestyles by purchasing things that consume silver to produce. Reduced supply and increased demand will tip the scales to an obvious delivery problem. The resulting silver purchases by industries and investors will be unprecedented, with a price rise that will be legendary. YMMV so DYODD

The conundrum of rising mining costs, but low silver prices (posted 4/06/2014)

The plunge in copper can push silver higher (posted 3/12/2014)

Dr. Copper has a new prescription, and it does not look bullish for some markets, but I continue to think silver will be an exception. The recent price plunge in copper will translate to reduced output from copper mines, and probably also from mines of other base metals. Since approximately 70% of new silver production is byproduct from base metal mining, the supply of new silver will drop sharply along with the reduced base metal mining output. As other factors continue to push the demand for silver higher, at the same time that the supply of silver drops, the resulting higher prices will create a vise to squeeze the silver shorts. The timing is uncertain, but I think accumulating silver below $25 will prove to be very profitable.

Here is the copper chart through 3/11/2014 from  Ed Steer's column:

Ed Steer's column:

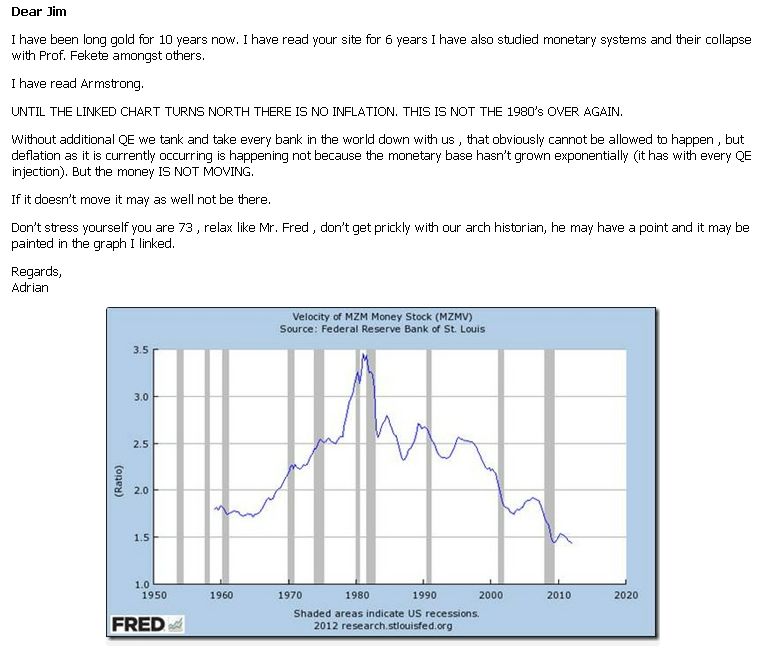

Could hyperinflation be imminent?

(posted 10/3/2013)I see things as unchanged (except for being worse) from June of last year:

Optimist: My view is that low velocity of money is much like a dam (operated by banksters) that is releasing only a small amount of water. Even though the FED is dumping massive amounts of water behind the dam (so that the water level is rapidly rising), the farmers downstream are complaining about a deflationary drought because they see so little water being released. That will change in a New York minute when the dam breaks or the banksters open the floodgates. All those who are complaining about deflation need to have their silver and gold life raft inflated and ready to use quickly when it is needed.

Another appropriate analogy is a mountain range covered in an unstable level of very deep snow (US$), and the FED keeps dumping more "snow" on top every day. An avalanche is inevitable. The question is when a trigger will begin that avalanche. That trigger could be imminent. Over the next three weeks, rampant rumors of a USA debt default (resulting from a failure to raise the debt ceiling) will reverberate around the world with increasing intensity. If there was a true debt default from a politically paralyzed USA government, the US$ exchange rate would plummet compared to more stable currencies. Nations and individuals who hold dollars will be pressured to dump them in advance of the potential debt default to salvage whatever value they can before everyone else tries to squeeze through the small $ exit door at the same time. The US$ exchange rate is already down significantly, and everyone knows that it could literally waterfall to much lower levels. It would take only one nation (or perhaps just a few wealthy individuals) to panic and be the first to dump dollars to trigger the avalanche.

FWIW, I do not think a debt default will happen. My guess is that if Congress remains uncooperative, the President will unilaterally declare the debt ceiling to be null and void (by virtue of the 14th amendment), so the FED can continue to print as much new funny money as needed to buy everything the government wants to spend money on. But it is of no consequence what I think. If big money panics to dump dollars before a possible debt default, then the potential exists for the rest of the world to pile on and for the US$ to quickly move to its tiny true value. When that feeding frenzy of $ selling at any price begins, it will be impossible to buy a lifeboat of physical precious metals. For the sake of those who are not fully invested in advance, let's hope that the dam will not break and the avalanche will not start this time.

Do the FEDanksters want metals prices to rise, but slowly? (posted 8/19/2013)

In response to a comment that a correction could happen over the next few weeks, I said:

That is close to my Wild A$$ Guess. Metals could extend this rally for a few more days, but then I expect that the banksters will step on silver again, just in time to rain on the parade of anyone who is thinking about taking delivery of the September contract. My conspiracy theory is that the banksters are no longer as much focused on making profits, but now they are more concerned about managing metal deliveries.

A follow up question was why would the banksters have recently gone long metals if they plan to further suppress the price, and I replied:

My guess is that the banksters are acting in collusion as agents of the FED (which is why the banksters are never punished for the things they do), but that the FED keeps them on a short leash. My new and original (Google cannot find it as ever used before) term for the FED plus the banksters is FEDanksters. Although the past bankster actions to suppress metals prices have been profitable, that bankster profit was serendipitous to the FED’s agenda to support the dollar by depressing metals, which are the only real competitor to the dollar. In theory, metals depression could have continued much longer, and driven prices much lower, but the FED is alarmed by the dramatic rise in accumulation of real metals by nations and investors. My guess is that the FED now wants metals prices to rise (so that higher prices will discourage physical accumulation), but at a slow pace to control the level of bullish enthusiasm that rapidly rising prices would generate. If that view is correct, then the FEDanksters have been accumulating metals into the decline, not to profit from the subsequent rise in metals prices, but to have ammunition they can use to sell into those rallies to control the level of bullish sentiment. I would be surprised if the FEDanksters press the short side hard enough to cause much lower prices. My guess continues to be that the FEDanksters’ new game plan is to allow metals prices to rise slowly over time, but to prevent prices from spiraling higher in a way that could get out of control. As one small data point, the JPM house account accumulated a large amount of silver by stopping (taking delivery) 82% of the July contracts tendered by the shorts. If JPM was intent only on making profits, then the way to do that would be to continue to accumulate at current low prices. Instead, so far this August (off cycle for silver delivery), the JPM house account has issued (delivered) 69% of silver contracts. That is consistent with a FEDanksters agenda to slow the rise in metals prices to dampen the level of bullish enthusiasm. For anyone interested in politicians and FEDanksters, it is good advice to ignore what they say, but watch what they do.

Another tiny dot to connect (posted 8/10/2013)

Here is another tiny dot to connect. Throughout the July delivery month, JPM's in house account stopped a large proportion of the silver issues, and thereby accumulated a significant amount of silver. The tiny dot is that on 8/09, JPM's in house account issued all 10 of the silver contracts that were stopped in the off month for silver delivery. If that is part of a larger trend, then JPM could have been accumulating silver on price weakness so it would have "dry powder" to deliver into rising prices. That could imply that JPM expects prices to rise from recent lows, and it wants to be in a position to "manage" (i.e., slow down) the rise by delivering its previously stopped silver into the rise as needed. It is not too much of a stretch to guess that JPM is now accumulating gold deliveries to be able to issue them later into rising prices to contain the bullish sentiment at the current low prices. Assuming that JPM is in lock step with the FED, it is possible that the FED expects metals to rise, and is preparing to blunt the impact of that rising price situation. It is a stretch, but also possible, that the FED wants metal prices to rise (because low prices result in too much physical accumulation by strong hands), but slowly enough that it doesn't generate unwelcome bullish enthusiasm. YMMV so DYODD. :-)

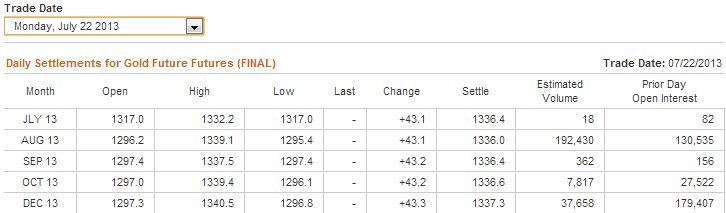

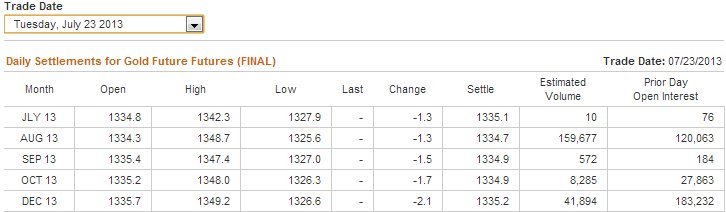

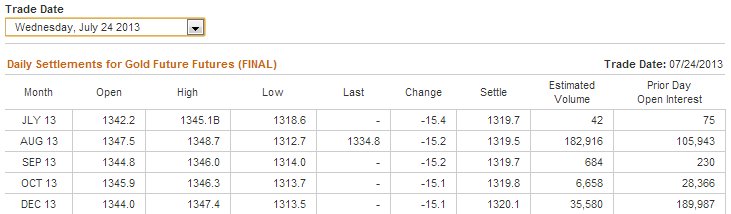

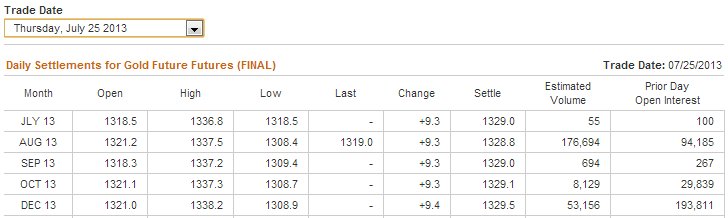

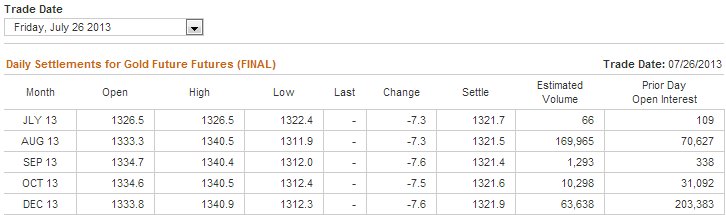

Possible beginnings of Metals Backwardation (posted 7/25/2013)

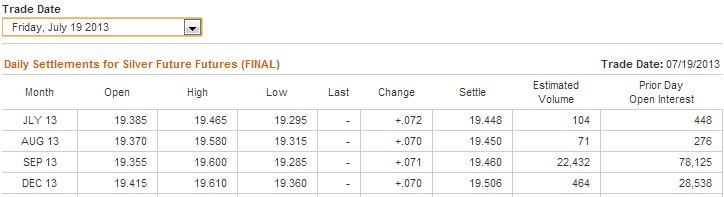

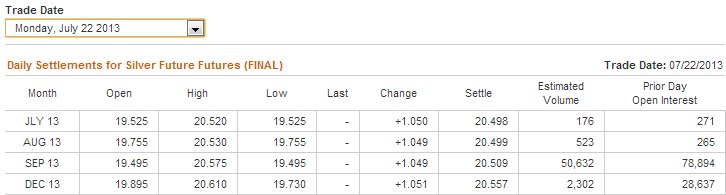

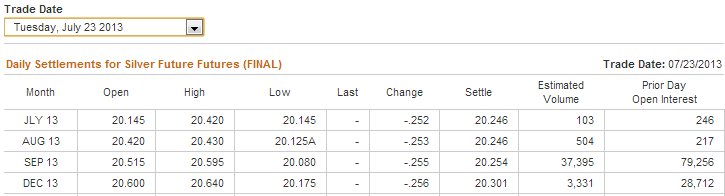

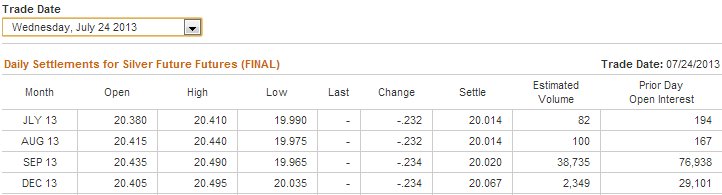

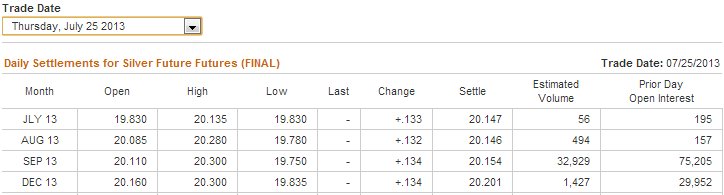

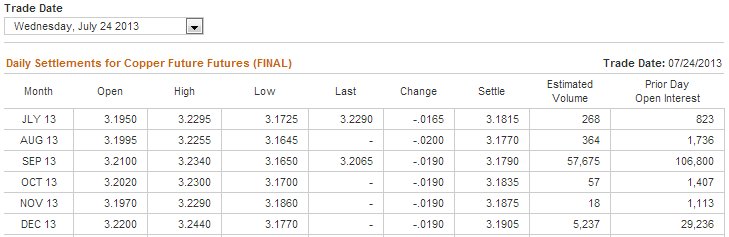

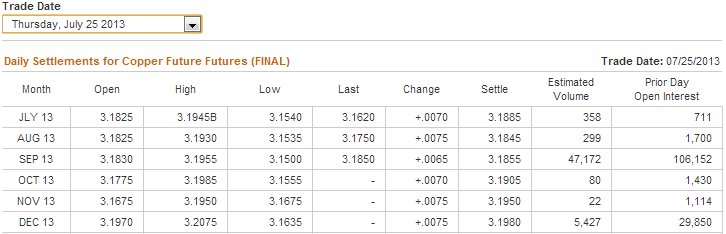

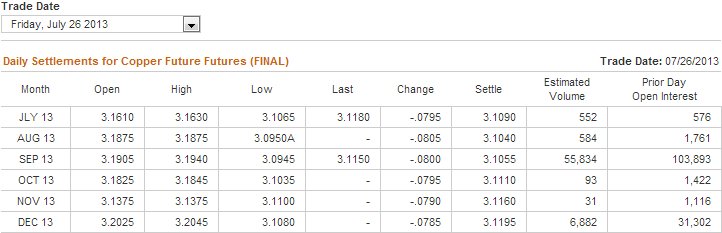

Comex silver futures settlements over the past week:

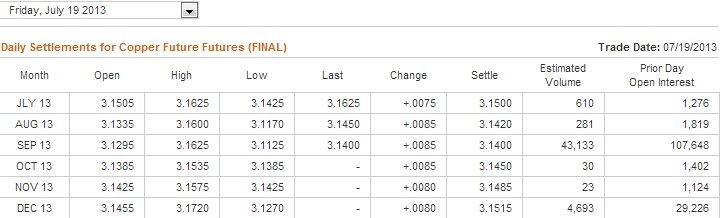

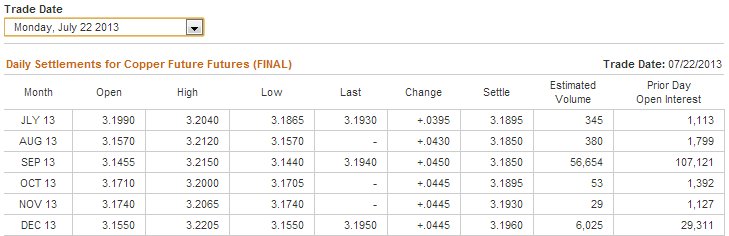

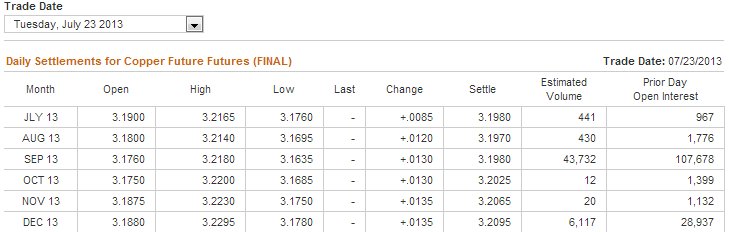

Comex copper futures settlements over the past week:

China signals will cut off credit to rebalance economy

(posted 7/07/2013)If China continues to press their interest rates higher to drain excess credit from their system, there will be serious implications for us too. Higher interest rates in China will put more pressure on interest rates to rise in the USA and Europe. The FED will need to pump more QE cash into the financial markets to slow the rate of increase. Higher interest rates in China will also press the Yuan exchange rate to rise faster against the US$. That rising Yuan exchange rate will be directly translated into higher consumer prices in the USA, at the same time that rising interest rates will press down on the USA economy. That sounds to me like a recipe for lower stock market prices, but I am less confident about which way metals will move. In normal times, when the FED is pushing interest rates higher to slow an overheated economy, metals would likely drop as a result, but these are not normal times. The FED is likely to work at pushing interest rates down to at least slow the rate of increase. Metals may respond more to the rising USA inflation rate, and the prospects for faster creation of liquidity by the FED. We may soon be able to see what the ancient Chinese curse "May you live in interesting times." really means.

China signals will cut off credit to rebalance economyChina said on Friday it would cut off credit to force consolidation in industries plagued by overcapacity as it seeks to end the economy's dependence on extravagant investment funded by cheap debt.In a statement from the State Council, or cabinet, Beijing laid out broad plans to ensure banks support the kind of economic rebalancing China's new leadership wants as it looks to focus more on high-end manufacturing.President Xi Jinping and Premier Li Keqiang have flagged for some time that the rapid growth of the past three decades needs to shift down a gear, and analysts said Friday's announcement was a signal that they intended to press on with reforms despite evidence of a sharper-than-expected slowdown."The guideline shows China's policymakers will focus more on economic restructuring to stabilize the economy rather than providing more liquidity to support economic growth," said Li Huiyong, an economist at Shenyin Wanguo Securities in Shanghai.

http://www.reuters.com/article/2013/07/05/us-china-economy-idUSBRE9640CG20130705

Possible double bottom in silver

(posted 5/16/2013 at 07:20)In the "fools rush in where wise men fear to tread" department, I will hazard a guess that the $22.03 low earlier today may be the bottom of this correction, and the next wave higher could begin today. That $22.03 is an almost perfect double bottom with the spike low from a month ago, and it could form a base that is capable of launching higher price action. Sorry for the weasel words "may" and "could", but that is the best I can do for now. Someday I hope to graduate to the advanced level of the internet lunatics who can post the most outrageous things many times a day without actually saying anything that could be remotely proven wrong by future price action.

If my Wild A$$ Guess about this is incorrect and prices drop further, please don't feel any need to tell me about my error. I will feel it in my accounts, because I am betting my funds where my mouth is.  DYODD!

DYODD!

Perspective after the metals price plunge (posted 4/17/2013)

A friend asked about my views on the timing for silver purchases now. Here was my reply:

Thanks for asking me about timing, but I must confess that I can't give a useful answer. My previous guidepost was to expect high prices in early spring (around this time of year), followed by a correction into late summer, and then a sharp rally back into higher prices by the end of the year. With that in mind, I committed in the summer of 2011 to travel that December so I could purchase real estate with the profits I expected to take from the anticipated rising prices. That didn't work out well, so I repeated the same process in 2012, with the same bad results because there were no profits to take then either. I am as shell shocked as everyone else about the severity of this latest price plunge.

For what its worth, I had not been buying into the low prices earlier this year, even though I thought there were great bargains, because of caution about the rising levels of open interest (the number of buyers and sellers) in the futures market. The combination of falling prices and rising open interest told me that the short sellers were pushing the market lower, so I resisted a strong desire to buy more. Fortunately, by not buying earlier, I managed to save a significant amount of cash for purchases when the open interest returned to a more normal pattern. Well, the open interest picture now is worse than it has been before, and I continue to be cautious about new purchases. Even so, I could not resist the price plunge, and I deployed about 25% of my buying power into silver on Monday. If prices continue to drop, or just stay down, over the next few months, I will make more purchases until all my buying power is used. I refuse to even consider selling anything at these low prices because I am certain that prices will rise much higher once again, but I really have no clue about when that will be.

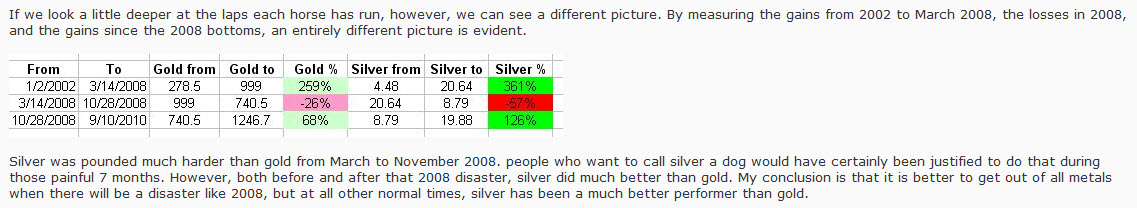

The one data point I can offer is that the price plunge in 2008 was the worst since 1980, and it seemed like the financial world was ready to implode. Then silver dropped from $21+ to less than $9, so a drop of more than 50%. Silver has now dropped to $23 from $50 two years ago, and that too is a drop of more than 50%. From the 2008 low to the high in 2011, silver prices went up more than a factor of 5. I would not be surprised (and I would be VERY happy!) if the price of silver goes up by a factor of more than 5 again over the next few years. The hard part is guessing where the bottom of this move will be to get the low point to measure the advance from. I will be able to tell you with confidence what that low price was, but only after a few months have passed after the low to improve my vision. From now until a few months after the next price low, your guess about the bottom is just as good as mine! Good luck!

A bigger channel for the MoreAU Index (posted 12/22/2012)

An alert reader, J.L., offered a larger scale view of the MoreAU Index to show that it is in a long term channel since 2001. J.L. explains:

You show on the chart the 3-4 channels that are medium term (couple years each), but I can see a broader channel that spans the entire time frame, shown below in doted green. I think it puts the recent sideways chopping into perspective.

Thanks J.L.! Happy Holidays to you, and to all our readers. Cheers! Jim

Surprising strength of silver (posted 11/16/2012)

An analyst I respect commented today about the surprising relative strength of silver this week compared to gold, mining stocks, and the general stock market. Here is my contribution to that discussion:

I have been following Jim Sinclair's advice in times like these to those of us who are fully invested. Get into a hole, pull a large rock over the top, and then wait patiently until the storm passes. I too noted the relative strength of silver. Silver open interest is another anomaly that suggests the buyers are holding firm in the face of increased shorts by the banksters. The charts below show the weekly open interest reported by  Futures Trading Charts for all weeks except the current week. You can click any earlier bar to see the open interest for that week. The open interest for this week will be reported next Friday. I assume that the data reported is the sum of open interest in all the futures months, so it would include futures spreads but probably not include options or other data. I am cautious about interpreting these charts because I have not yet been able to correlate them to most previous price swings, but the patterns are interesting. Note that the open interest in gold has been declining in recent months while the open interest in silver has been rising.

Futures Trading Charts for all weeks except the current week. You can click any earlier bar to see the open interest for that week. The open interest for this week will be reported next Friday. I assume that the data reported is the sum of open interest in all the futures months, so it would include futures spreads but probably not include options or other data. I am cautious about interpreting these charts because I have not yet been able to correlate them to most previous price swings, but the patterns are interesting. Note that the open interest in gold has been declining in recent months while the open interest in silver has been rising.

Larger charts are updated each week at  http://sitekreator.com/Optimist/charts.html. Scroll down to see the links to updated charts on silver and gold open interest.

http://sitekreator.com/Optimist/charts.html. Scroll down to see the links to updated charts on silver and gold open interest.

In the "Hope springs eternal" department, I think a time is likely to come when wealthy individuals, and/or organizations, and/or nations decide to execute a massive short squeeze by buying large quantities of undervalued physical silver. Could a firming open interest in the face of artificial price drops be a sign that big money is accumulating now?  Increasing their long futures holdings and spreads (as Jim Sinclair noted would be a good way to hammer the bears) could be the first step in a massive buying plan.

Increasing their long futures holdings and spreads (as Jim Sinclair noted would be a good way to hammer the bears) could be the first step in a massive buying plan.

Everyone knows the way the exchanges changed the rules in 1980 to steal from Bunker Hunt, so the new players will not depend on the integrity or honesty of the exchanges. Instead, they are likely to make side deals with miners to deliver physical directly to them independent of the paper prices on the exchanges. If we see shortages of silver and increasing premium costs, the game could be on.

More about when to buy silver (posted 11/07/2012)

In response to my guess about when to buy silver, one wag looked at the precipitous drop and said "Not yet... not yet..."

to which I replied:

When? . . . When? . . . ![]()

Actually, I didn't say it well in my first post. I think it is ALWAYS a good time to buy PHYSICAL silver to hold in your CORE positions. That physical silver should not be for sale to increase your amount of paper cash, but should be kept as INSURANCE against the disastrous things that can happen in the economy. The 50% pullback this past weekend and Monday morning were good times to use available cash to increase your holdings in the paper positions (such as mining stocks, ETFs, etc.) you will use for trading (to sell at a profit later and thereby increase your cash available to buy more physical and more trading positions). As for when to sell those trading positions to capture your profits, I can only quote our noted timing guru "Not yet... not yet...". ![]() I continue to HOPE that silver can test the US$100 level within the next six months. There is more detail and a chart about that in my commentary The Silver Two Year Cycle Continues. Cheers!

I continue to HOPE that silver can test the US$100 level within the next six months. There is more detail and a chart about that in my commentary The Silver Two Year Cycle Continues. Cheers!

Update to my guess about when to buy silver (posted 11/02/2012)

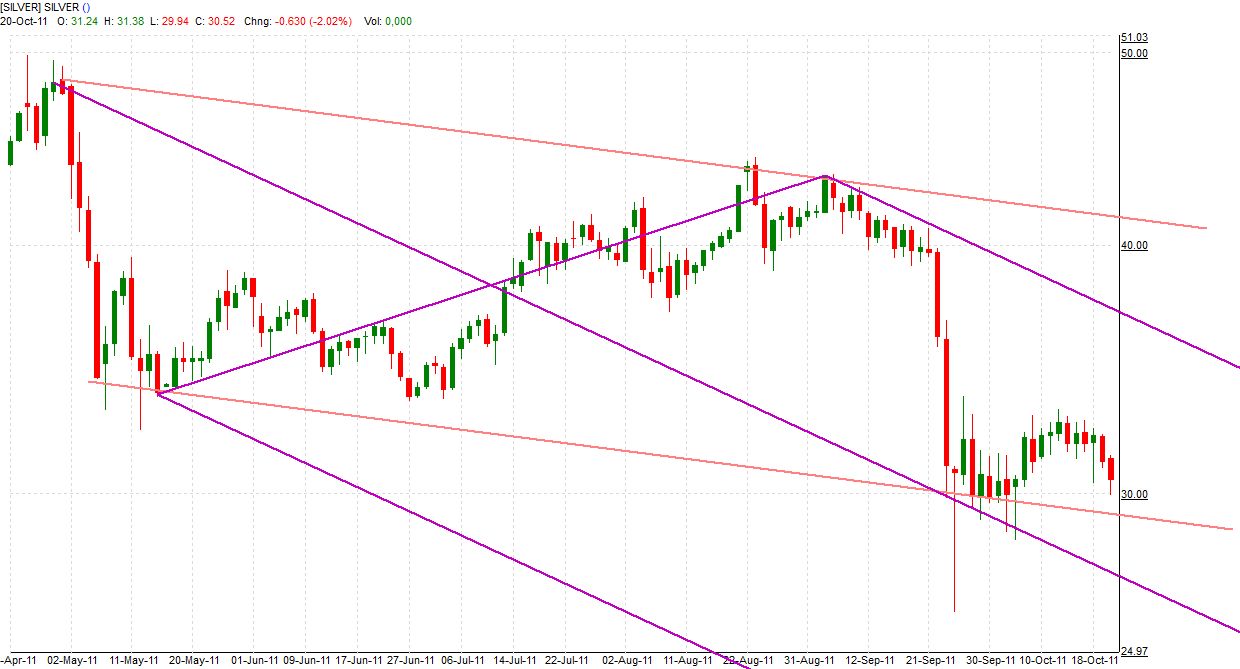

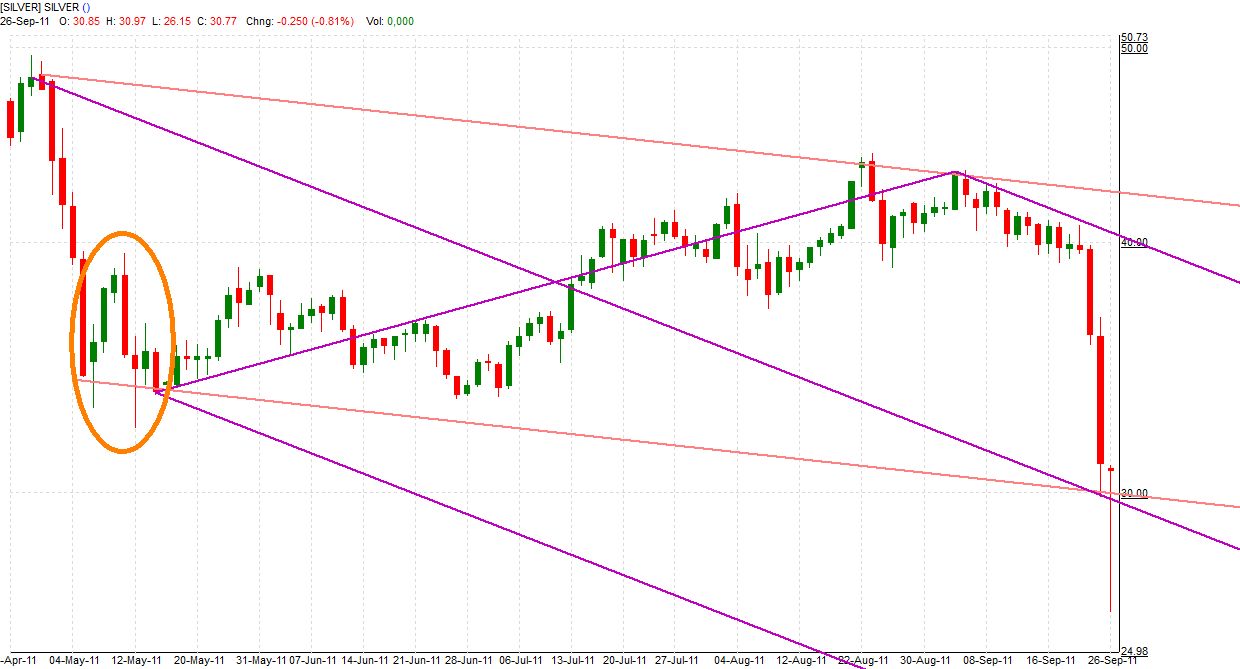

On a more serious note, I will not be able to see a bottom in this market until the price has moved back up high enough to break the downtrend line shown in red on the chart below. My idea of a good "Buy Silver - NOW" point is after the downtrend has been broken, and then prices correct back lower to perhaps 50% of the rise from the bottom to the top of the move that breaks the downtrend line.(posted here in mid December)

The time has come, the walrus said, to speak of many things . . ., perhaps including my mid December point above about when to buy silver. The red line downtrend was broken in late August, and the price of silver is now only pennies away from a 50% correction of the move up from the late June low. Now looks like an excellent time to buy physical silver. Obviously the banksters can push the price of silver lower in the short term if they want to do that, but my WAG (and I emphasize GUESS) is that the price plunge in all commodities was timed to paint the best financial picture possible for the election, and I GUESS again that the low point for this correction is close in both price and time. An updated chart is provided below. DYODD is needless to say, but I need to say it again. :-) Cheers!

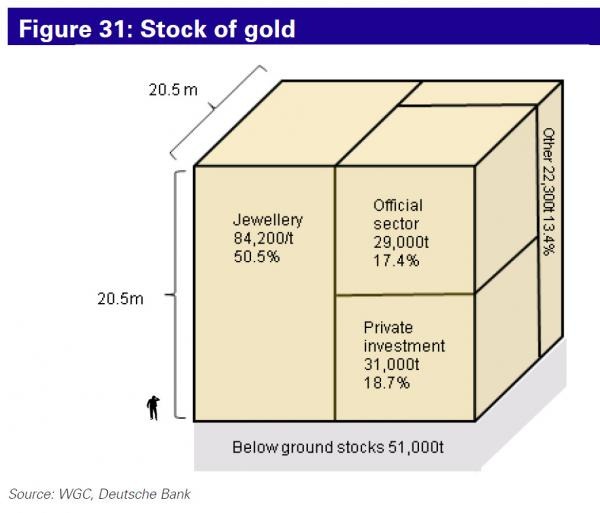

Stock of gold (posted 9/29/2012)

I recently posted this chart (copied from Jim Sinclair) with my comment below:

Gold is a good stock, but there is even less silver bullion and it is consumed by industry, so silver will rise faster than gold.

http://www.jsmineset.com/2012/09/27/jims-mailbox-1051/

An alert reader called me to task with the paraphrased exchange below. Enjoy!

Reader: Don't tell me you are buying gold stock! I hope it isn't one of the dreaded ETFs!!

Optimist: I used the word "stock" as a pun on the attached graphic title "stock of gold", but sometimes my puns are a little puny. :-)

Reader: Buy physical silver (and gold), and securely store them in a safe place where you can get to them without needing the permission or assistance of anyone else. Silver has appreciated more than gold since the start of this bull market in 2001, and I have no doubt that silver will continue to move up faster than gold over time.

Optimist: I can't argue with a man when he is right! :-)

Reader: The lower price of silver causes it to be more volatile than gold.

Optimist: This reader's digest version leaves out a few important details. :-) Higher volatility for silver is the result of massive moves higher and lower. The bullish moves higher for silver are driven by the recognized fact that the price of silver is seriously undervalued, so investors are correctly buying more whenever they can. The natural progression to much higher prices is short circuited by bankster barrages of dumping more paper shorts than there is physical to cover those shorts. That cycle of correct higher highs interrupted by criminal bankster price plunges creates the increased volatility, which will continue only as long as there is enough physical silver available to supply to industry for manufacturing consumption and to investors for accumulation. When the time comes that industry has difficulty acquiring physical metal for their just in time manufacturing processes, industry will rush to correct the long overdue substantial increase in their stock levels, and the banksters will be unable to dump paper to suppress the price because most investors will want the physical that is in short supply. The resulting explosion in the price of silver will be legendary!

Reader: A slowing world economy will reduce the demand for silver.

Optimist: Most of the investment world shares this view that silver is only a banged up, rusty, and little loved car in the used car lot, and that it only moves slowly forward when fueled by the consumption demands of a healthy industry. They reason that the silver car will stall when the fuel of industrial expansion is no longer available because industrial demand for silver will diminish. A few investors, however, will look under the hood, and they will see a powerful jet engine with afterburners. As the world economy continues its inevitable slide into depression, and as China reaches its overbuilt plateau, The demand for copper and other base metals will essentially drop to zero and the warehouses will quickly fill to the maximum. The base metal miners will be forced to essentially shut down their mines. Since more than 70% of silver supply is byproduct from base metal mining, that 70% of silver supply will vanish from the marketplace, and the loss of silver supply will be the jet engine that propels the silver car to much higher prices. The afterburners will be the huge short positions of the banksters who will be caught in an epic squeeze from industry and investors who buy physical more frantically as the supply of silver becomes much too low to supply the demands for physical. You can read more about this in When Will the Price of Silver Explode?. Get your physical silver now, and buckle your seat belt for the ride of a lifetime! :-)

Preparations, precious metals, and investments for profit

(posted 9/19/2012)I was recently chastised mildly for focusing so much on precious metals instead of on preparations which will be essential during the coming economic collapse. Here was my reply:

Forgive me, Father, for I have sinned. :D

I must confess that although I agree that the wheels could fall off the economic cart (which is constructed only of debt and Ponzi promises!) at any moment, so that anyone without preparations (food, water, secure shelter, and self defense) would be at the mercy of mobs intent on stealing what the thieves did not prepare, I am optimistically hopeful that the inevitable rupture of society as we know it will be delayed a few more years. During that time, I continue to allocate a portion of my assets to purchasing real physical precious metals, and to investing in the companies which mine or process those metals. The physical coins or bars of precious metals are not for sale as an investment, but are intended to be held indefinitely as insurance against disastrous things that can happen, or possibly to be traded for more secure property later. With a portion of my funds that I invest in precious metals companies, my intent is to sell them at a substantial profit into the next major leg up in the price of metals. I continue to hope that short term bet will provide profitable opportunity by the spring of 2013. {I outlined that approach here (with charts and details) in my commentary "The Silver Two Year Cycle Continues".} The profits I hope to make will go into buying more preps and later more metals and more investments to play the game for another cycle. At some point, that game will end, but I am not gifted enough to guess at when that endpoint will be, so I plan to keep playing (and prepping) until the game changes. When the wheels do fall off the cart, many people will not know the real value of the various precious metals, but those unprepared people will be at high risk for early termination. The survivors will quickly learn the real value of all coins and bars, including palladium and silver (which are more rare than gold).

If you have an IRA for retirement, read this! (posted 9/16/2012)

Although  WIllie Sutton didn't really say it, you can be sure that the U.S. Government continues to have admiring fantasies about the line "That's where the money is." There can be no doubt that the USG is well aware that there is a huge amount of money locked away in IRA accounts that the baby boomers can not yet get their hands on. If the wheels fall off the USA economic cart in the next few years, I have no doubts that the USA will "protect" those IRA accounts by converting them to T Bonds with a very long maturity (100 years?!) and a very limited payout schedule. Anyone who plans to use IRA funds for something more useful (like buying silver or gold, for example) should seriously consider these screenshots from Jim Sinclair yesterday.

WIllie Sutton didn't really say it, you can be sure that the U.S. Government continues to have admiring fantasies about the line "That's where the money is." There can be no doubt that the USG is well aware that there is a huge amount of money locked away in IRA accounts that the baby boomers can not yet get their hands on. If the wheels fall off the USA economic cart in the next few years, I have no doubts that the USA will "protect" those IRA accounts by converting them to T Bonds with a very long maturity (100 years?!) and a very limited payout schedule. Anyone who plans to use IRA funds for something more useful (like buying silver or gold, for example) should seriously consider these screenshots from Jim Sinclair yesterday.

The FED announced QE forever (posted 9/13/2012)

I don't see the FED announcement today as a game changer. I am convinced that the FED was pumping as fast as they could during the previous months, and today's message simply brought them out of the closet so they could pump some in the sunshine (with more still in the dark). The FED message did ratchet up investor sentiment, and that should provide more near term upside gains, but my guess is that the banksters will be happy to punish the momentum gamblers several times over the next few months to slow the rate of increase. My big picture continues to be unchanged from The Silver Two Year Cycle Continues, and I still hope that silver will test $100 by April. In the shorter term, I plan to take a few profits near $37 to replenish a little of my buying power in case the banksters do a brief but sharp dump from near that level to one of the Fibonacci pullback levels (after adjustment to the recent high). Later I hope to have an opportunity to rinse and repeat that partial profit taking exercise near $49. Here is a near term chart updated through today.

Silver is up! Should I buy now, or wait for a correction? (posted 9/10/2012)

"Ludicrous" is a very strong word. Silver is still near its channel lows even after breaking out of the 16 month long correction. As shown in The Two Year Silver Cycle Continues, I continue to think it is possible that silver could test $100 by April 2013. In this very bullish environment, consider how the shorts must feel. It would not surprise me if silver continues to thrust higher in the short term, but a correction at any time would not surprise me either. I am still all in, so I don't need to worry about buying, but I view anything below $35 as a good buy point. Even if silver corrects back down to $30 after buying at $35, that is no disaster. Just try to accumulate more cash to buy more during a correction and hold until prices move higher again. If I had a significant amount of fiat available now, I would use a version of dollar cost averaging with a target to buy with approximately 10% of my cash each week, but adjusted so that I would only buy with 5% after a strong rally that week, or with 15% after a correction during the week.

None of us knows when the silver market will have a normal correction, or when the banksters will do a dump to punish the momentum gamblers, so buying a little each week will reduce the risk of getting caught by buying too much at too high a price so there is no cash left to use in a sharp price downdraft. FWIW, my WAG is that a normal modest price correction is likely soon (and a bankster dump is inevitable at some point), but I would not wait for that to begin a routine buying plan. It is important to remember that silver and gold are not just investments to buy low and sell high. Precious metals (that are core investments and are held in secure storage) are also insurance against some really terrible things that can happen, possibly quickly and with little warning. Keeping a solid base of good preparations (including precious metals) is essential, IMHO. YMMV so DYODD!

The reason government suppresses the price of silver (posted 8/19/2012)

http://www.lemetropolecafe.com/ includes this insightful paragraph:

http://www.lemetropolecafe.com/ includes this insightful paragraph:A busted Silver market will spill over into everything. This one "little white lie" will expose many and far larger lies up to and including the fact that the entire system is a Ponzi scheme. It is really this simple, Silver CANNOT be allowed to be "outed" because it will expose everything else so don't hold your breath for a miraculous CFTC ruling, failure to deliver WILL be the catalyst.

I see this as the key to understanding the reason why the U.S. government (by using banksters as its agents) is actively manipulating the silver market. It isn't about the profits that the manipulation makes by stealing from the gamblers who bet on momentum. I think the real reason is that there is not enough silver to meet all the demands for it. Since silver is essential for manufacturing and for national defense, the government agenda is to suppress the demand from investors and speculators by punishing them with vicious declines when prices get pushed uncomfortable high, and by trying to hold the price down below those energetic levels that invite more buying. The key to breaking that manipulation is accumulation of physical silver. After the level of available physical silver bullion drops sufficiently that it becomes a potential problem for consumption by industry and national defense, then government will stop the manipulation by price suppression and control silver the old fashioned way - by rationing it to the favored few. The cost to the rest of us to buy a little of the remaining amount of physical silver still available then could be prohibitively high, so buy your physical silver now while government suppression keeps the price at bargain basement levels.

Physical for core holdings, but miner stocks for trading (posted 7/27/2012)

A few days ago, someone commented that all of ones investment capital should be put into physical metal. This was my response:

I agree with holding your core position in real physical metal. However, there is still a very useful role that buying and selling precious metals miner stocks plays. There is a problem with being 100% in physical if you want or need to sell some. Selling and buying physical entails significant premium/shipping costs, and some degree of risk, and possibly a lot of exercise if moving a substantial amount of silver. Those problems are not a major factor for your core holdings when you buy once and hold for a very long time, but they can be a very big factor if you are trading a portion of your physical holdings. My view is that core holdings of physical are like an insurance policy that you simply hold without question as protection against some major economic risks. I do use a portion of my funds, however, to buy low and sell high to generate profits that I can use to buy more physical. My approach for doing that is summarized in the thread about the two year silver cycle (The Silver Two Year Cycle Continues). I am currently long 100% in hopes that silver and gold are near their summer lows for this cycle, and in hopes that prices will be much higher in the next nine months. Unless the wheels fall completely off the USA economic cart before the next cycle high for precious metals, holding miner stocks is likely to be as profitable (and perhaps much more profitable from the current very low miner stock prices) as holding physical metal. Since I plan to sell the trading portion of my position into the next high cycle anyway, it makes a lot of sense to hold that portion of my equity in mining stocks so that I can sell with much lower transaction costs.

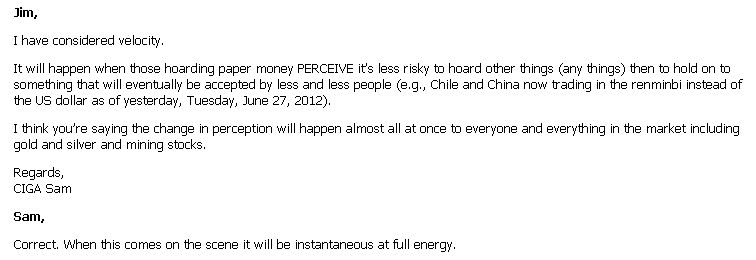

Velocity of money (

posted 6/28/2012)

Jim Sinclair had a good debate on the velocity of money today. For those who missed it, here are screenshots of the exchanges. My view is that low velocity of money is much like a dam (operated by banksters) that is releasing only a small amount of water. Even though the FED is dumping massive amounts of water behind the dam (so that the water level is rapidly rising), the farmers downstream are complaining about a deflationary drought because they see so little water being released. That will change in a New York minute when the dam breaks or the banksters open the floodgates. All those who are complaining about deflation need to have their silver and gold life raft inflated and ready to use quickly when it is needed.

I am buying the dips in gold and silver (posted 6/21/2012)

My Wild A$$ Guess is that this drop could be a precursor to a coordinated bailout of European banks, and the banksters are forcefully selling the rumor (or more likely the certain insider news that their owners have told them about in advance) this week. If that is true, then I would expect more selling early Friday to cement the message that precious metals are not the way to bet against the mountains of fiat that will soon be unleashed by the ECB and the FED. The powers that be prefer to persuade Joe six pack to not take advantage of this opportunity. After the bailouts are announced (possibly this weekend), there will no longer be any need to paint the tape to make metals look bad. Indeed, selling into the rise that will follow the bailout announcements would be foolish even for the banksters (who will be buying back their short positions before the news)! Even if there will not be any bailouts announced this weekend, the current plunge in prices is the type of dip that we should be buying so we can sell later at much higher prices. I plan to invest the remaining amount of cash I have saved by buying on Friday. I want to be 100% in for the weekend. If prices continue to drop next week and later, then I will simply hold until prices eventually rise again, as they surely will. It is times like these that makes us more appreciative of the advice to not buy on margin (because fear would force us to liquidate leveraged positions "before it gets worse"), but to only buy with available cash so we can take the heat and hold until the markets improve. YMMV so DYODD.

Silver Seasonals (posted 6/14/2012)

Will global intervention be next?

(posted 6/06/2012) A recent article speculates that a round of global intervention is just around the corner. Here is my thought about that possibility:

A recent article speculates that a round of global intervention is just around the corner. Here is my thought about that possibility:If there is a coordinated action, precious metals investors will hear the drums beating first. You can bet that the first step in any intervention is to hit precious meals hard so their prices (which will rise anyway, but more slowly after the hit) will not be seen as a reliable and safe haven through the financial storm. Be prepared to buy a sharp price dip before the news, because prices should quickly reverse back to the upside after the intervention news is released.

Excellent paragraph in new Ted Butler article (posted 5/11/2012)

Knowing the Game) goes over the bankster manipulation and the non response by useless agencies that many of us have heard about before, but it also includes the paragraph below. This paragraph sums up my viewpoint very well:

Knowing the Game) goes over the bankster manipulation and the non response by useless agencies that many of us have heard about before, but it also includes the paragraph below. This paragraph sums up my viewpoint very well: What can we do about this as investors, market participants and citizens? I can only speak for myself, but I am not selling silver here or lower. I don’t know how low we may go from here and there is nothing I can do to prevent a decline, so I’m not going to obsess over it. As new funds become available, I’ll buy more silver. I’m in it for the long run or until I see signs that silver is free of manipulation and exhibiting signs of overvaluation. That’s very far from the case presently. The COT structure was bullish before this last sell-off and is even more bullish now. Try to remember that the collusive COMEX commercials are buying, illegally in my opinion, but buying nevertheless. No one, not even a crook, buys anything that he doesn’t expect to rise in price. Certainly at past extremes of commercial buying, it invariably turned out to be a good time to buy. The key test will be if JPMorgan sells short additional contracts on the next meaningful silver rally. Although that rally may not feel close at hand, I can assure you that we will get it eventually and the answer to what JPMorgan will do. When the rally does come it should prove to be explosive if JPMorgan decides to quit manipulating the price.

Some may scoff at the suggestion that JP Morgan could restrain itself from the easy profits it makes, but the news today about the huge loss JP Morgan announced may set the stage for a new ball game. Amid the shareholder lawsuits and the calls for more regulation that seem to be inevitable, JPM may decide that the kitchen is too hot now, and it should cool off out by the pool for while. Time will tell.

Are metals weaknesses caused by much higher margin requirements? (posted 5/03/2012)

Snip:

news came out last evening that CME was requiring all member firms to comply with regulations arising from Dodd-Frank which basically is forcing margin requirements for all "Non-Hedges" to effectively double as of this coming Monday.

Talk about short notice!

The ramifications of this are obviously huge and no doubt are adding to an already volatile mix of madness. Those traders with losing positions are going to be impacted even more since the new requirements may well push them over the line as far as margin calls and force them to either liquidate or come up with more cash, immediately.

I think some of what we saw in the markets today is traders already anticipating this with the result that we had a significant amount of position squaring.

Will the US$ drop soon? (posted 4/20/2012)

Could the next stop be $50? (posted 3/16/2012)

The blatant Bankster bashing continues. (posted 3/03/2012)

How high is up for the metals?

(posted 2/21/2012) Silver Price Could Double by Year End. This article prompted me to look at my own possible projections for a year from now. In the charts below, the top of channel line for silver is now at $67.50. That top of channel line will extend to $93 a year from now, and the price could overshoot to $96. The top of channel line for gold is now at $2,285. That top of channel line will extend to $2,750 a year from now, and the price could overshoot to $2,800. The thrust higher to those levels would yield a gain over the next year of 186% for silver and 61% for gold.

Silver Price Could Double by Year End. This article prompted me to look at my own possible projections for a year from now. In the charts below, the top of channel line for silver is now at $67.50. That top of channel line will extend to $93 a year from now, and the price could overshoot to $96. The top of channel line for gold is now at $2,285. That top of channel line will extend to $2,750 a year from now, and the price could overshoot to $2,800. The thrust higher to those levels would yield a gain over the next year of 186% for silver and 61% for gold.

This is NOT a prediction of what will happen, but only a projection of what is possible. DYODD, of course, but I plan to be very happy if silver and gold approach gains like those over this coming year!

The PM bull has ups and downs, but will continue to change ahead (posted 2/11/2012)

A short and shallow correction before the rally resumes (posted 2/03/2012)

Seeking Alpha article today summarizes my viewpoint very well.

Seeking Alpha article today summarizes my viewpoint very well.While I do believe we will potentially see silver and SLV over the $40 level by the end of February, I believe we will see some form of consolidation/pullback in the metal starting within the next few days. Generally, when silver is in a strong uptrend, as it seems to currently be, the pullbacks tend to be rather shallow, and should not be more than a couple of dollars. However, as long as we do not see any large spikes down in silver over the next week, which could potentially invalidate this analysis, then you will want to buy the upcoming consolidation/pullback for an even more powerful move up in silver over the rest of February.

Price targets, near and far

(posted 1/28/2012)

When will the silver and gold bull market end? (posted 1/24/2012)

Silver is beginning to shine again!

(posted 1/14/2012)

Another brutal Bankster Barrage! (posted 12/29/2011)

Another painful day of depressing drops in the prices of silver and gold. My view is that year end tax loss selling is a significant contributor to the current weakness in PM prices. On 12/26, I posted this:

2011 has been an unusual year for PM trends. The sharp rise for silver in April (but without participation by gold), the subsequent rise for gold in September (but without participation by silver), and the failure of either gold or silver to rise into year end, all point to a questionable view of the usual annual trends. I expect more weakness from tax selling into the end of December, but I am cautious about predicting the usual summer swoon. My advice is to dollar cost average with purchases possibly each week beginning in early January and continuing until the stack of available FRNs is much smaller. I don't know of any way to predict when the next big rally will happen, so I want to think like a Boy Scout and Be Prepared.

On 12/15, after silver completed a reversal day to the upside and the charts looked like the new bottom was in place, I was asked about the technical perspective for that bottom. Here was my reply:

I will not be able to see a bottom in this market until the price has moved back up high enough to break the downtrend line shown in red on the chart below. My idea of a good "Buy Silver - NOW" point is after the downtrend has been broken, and then prices correct back lower to perhaps 50% of the rise from the bottom to the top of the move that breaks the downtrend line. Until that downtrend line is broken, I am holding what I have, but not adding more with new cash. After the downtrend line is history, things will seem a lot happier here.

I remain convinced that 2012 will be much more friendly to silver and gold bulls than the second half of 2011. Keep the faith! Happy New Year to all!!!

Merry Christmas to all, and best wishes for a happy, healthy, and prosperous 2012!

Thoughts on trading the gold to silver ratio. (posted 12/14/2011)

With silver and gold prices down sharply, i have been asked about trading the gold silver ratio. Here is my reply:

Far more often than not, silver outperforms when prices are moving higher, but silver under-performs when metal prices correct to lower levels. I agree that the opposite happened this summer, but I see that as an unusual exception. I suggest an alternative approach in which you use the ratio to decide when to make a trade. If the ratio looks good for buying silver, or if the markets look positive for both metals, then buy silver with a known vehicle like AGQ to maximize your gains to the upside. Conversely, if the ratio looks better for gold, or if the markets look like a correction might lie ahead, then just sell the silver. Do not buy the gold part of the ratio trade (just hold FRNs as dry powder for a subsequent correction) because gold is likely to drop (although not as far or as fast as silver) whenever silver also drops. The best answer for trading that I can see is to always buy silver when the prospects for metals are bullish, and then sell the metals for FRNs (and possibly consider a smaller position in ZSL) when the metal prospects look short term bearish. Don't forget to use some of the FRN profits to increase the holdings of your physical metals for the longer term!

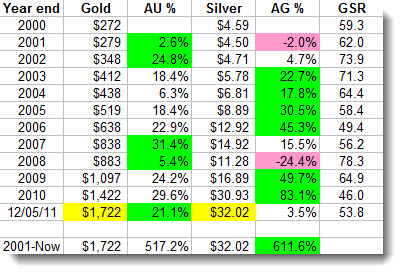

Comparing the gains of silver and gold.

(posted 12/05/2011)There seems to be a never ending debate about whether silver or gold is better. Here is a reply I offered today:

The current bull move began in 2001 when the FED put the 21 year long bear into hibernation by dropping nominal interest rates so far that the real interest rates went negative. All the price action before the bull began in 2001 is noise that does not impact the current market environment. The chart below looks at the percentage increase from 12/31 to 12/31 for each year using the indicated gold and silver closing prices on 12/31. I highlighted the "winner" each year in bright green. People who prefer gold will be happy to see that gold did better than silver in several of the years, and gold is indeed beating silver substantially so far this year. If gold continues to shine as much brighter than silver through 2012 and possibly into 2013, then gold could actually begin to catch up to the 612% gain of silver from 12/31/2001 to now. My bet, however, is that silver will soon resume its decade long winning performance. Cheers!

Why the price of silver will rocket higher.

(posted 12/03/2011)Someone asked what factors would drive the price of silver higher. I summarized the six points below:

(1) There are more (probably much more) than five Billion ounces of gold bullion collecting dust in vaults around the world, and more is added to the vaults everyday because more is mined than is used as jewelry or industry or investment products.

(2) There is less (probably much less) than one Billion ounces of silver bullion available for consumption by industry, and that number is further depleted every day because less is mined than is either consumed by industry or is converted into more valuable investment products.

(3) Perhaps 70% of the silver currently being mined is a byproduct from base metals mining. As the world continues to fall into a deeper inflationary depression, the amount of base metals that will be mined will reduce as worldwide construction demand decreases with the slowing economy. That inevitable reduction in base metals mining will further exacerbate the supply deficit in silver relative to the demand.

(4) The industrial applications that consume silver cannot reasonably substitute other alternatives, so those industries must have silver to continue their business. The amount of silver used in each product is small, so the use of silver is price inelastic because industry will continue to consume silver even after the price increases substantially from current levels. The real wild card is that all industries have migrated to just in time purchases of the silver that those industries must have. When news gets out that one industry is having trouble getting delivery on cheap bullion silver, there will be a stampede by all industries to lock in the physical they must have to continue production.

(5) The Banksters have been artificially depressing the price of silver for decades, and those criminals continue to squelch price rises in silver by selling huge quantities of paper that is not backed by anything. The investment world is beginning to realize that paper promises have little meaning, and that smart investors need to hold physical. As that migration to physical accelerates, the paper market will become much less relevant and the Banksters will be overrun with demands for physical. The explosion in the price of silver will be so strong that it will even be able to carry its little brother gold to higher prices.

(6) One silver problem is that buyers get too much metal for their money. As silver rises, it will not take as much space in secure storage, and big money people will consider putting some of their wealth into silver. That buying by big money will drive the price of silver exponentially higher, as each increase in price makes silver that much easier to store. People who prefer to buy gold because silver is too heavy and bulky will be happy to hear that someday they will be able to get much less silver for their gold, because the price of silver will increase so much more rapidly.

All in again, and it feels good!

(posted 11/22/2011)So far, the Banksters have been conspicuously absent from their usual price plunges, and silver feels very strong. I have repurchased the silver equities I previously sold, and I am all in again. I still would not be surprised to see a sideways action or even a push down later to get silver closer to the 32 level, but for now 32 seems to be the new floor. YMMV so DYODD!

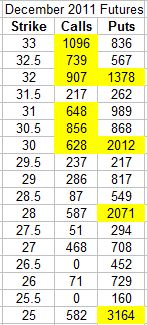

Could the Banksters target $30 for options expiration?

(posted 11/20/2011)This is not a prediction but only a what if guess, because I do not know what will happen with silver soon. However, if the price of silver begins to drop overnight tonight or into trading tomorrow morning, I would not be surprised if the Banksters force a spike down to the $28 level. That would allow them to pick off all the stops that are set just below the medium term down channel line (now at $28.50) and below the Oct. 05 low at $28.44 before they allow the price to rise back to $30. My guess is that spike down would be a great price to buy because the Banksters did not force silver to close significantly below the $30 level seven weeks ago and I do not think they want value buyers to have an opportunity to load up on physical below $30 now. Just getting the price to the $30 level by the options expiration on Tuesday would net the Banksters significant rewards on both the calls below and the puts above that strike price. The table below summarizes the current options open interest at nearby strike prices. It looks like the Banksters would reap significant options rewards for forcing the price of silver down to $30 by expiration, but I doubt they would get much bang for the buck on the costs to drive silver much lower than $30. After options expire Tuesday, my guess is that silver could begin a strong rally for the remainder of this year. YMMV so DYODD!

Buy now, or wait for lower prices?

(posted 11/17/2011)I was asked if it is better to buy silver soon, or to wait for prices to drop more. Here is my reply:

My advice is to buy some tonight, buy some tomorrow, and buy more this weekend. I think it is always a good time to buy physical, and the recent price drop makes this a much better time to buy than the previous three weeks. My guess is that prices could drop a little more over the next few days, but I doubt that there will be a major drop from the current price. When silver is selling for more than $60 next spring, nobody will care whether they paid $30 or $31 or $32 when they bought. The people who will care a lot are those who did not buy because they waited too long in hopes of buying at cheaper prices, and ended with buying nothing.

As always, DYODD before you decide when and how to invest. Cheers!

Will silver drop before options expiration?

(posted 11/15/2011)December silver and gold options will expire on Nov. 22, just 7 days from now. This would be a timely setup for the Banksters to step on silver again over the next week. There are approximately 5,000 calls and almost that many puts between 32 and 35. Those would be a tasty morsel for the Banksters to gobble up. My guess is that a price drop to around 32 over the next week would not be surprising. Although I am still very long in silver assets, I just today took profits on my AGQ to be sure that I will have some buying power if the Banksters depress silver soon. YMMV so DYODD.

Margins will increase, but no prior sell off?

(posted 11/04/2011) ZeroHedge and

ZeroHedge and  Trader Dan report that after the close today, the CME quietly raised the maintenance margins on EVERYTHING to be as high as initial margins. This could be big news if it is the start of a "war" against leverage. A strange thing about this, however, is that none of the markets had a typical hard sell off before margins were raised. Surely the Banksters knew this was coming, just as they did for all the previous margin hikes. So why didn't the Banksters do a massive sell today before the news? The only guess I can make is that the Banksters may want to get long ASAP, and they are no longer willing to risk selling more paper shorts to try to trick the gamblers into selling their positions to the Banksters. If that is the case, then after a brief knee jerk spike down Monday, the Banksters could launch a blistering rally.