Buy the Silver Sidestep for Super Profits

Absence makes the heart grow fonder! (published 7/11/07)

Hey! Its great to be back among friends. I’ve been doing other things for a few months, but now seems like a great time to talk about silver again. If history rhymes for the rest of this year, the Silver Sidestep looks like a fantastic opportunity!

What the heck is a Silver Sidestep?!

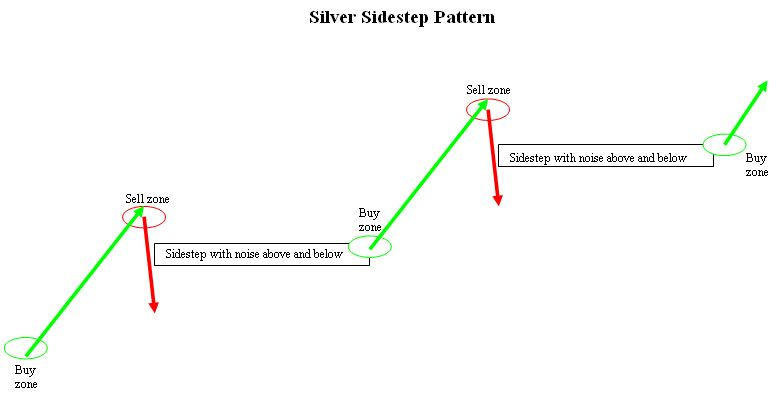

My fellow Texans will be happy to hear that the Silver Sidestep is not another dance craze like the Texas two step. The Silver Sidestep is a way of viewing a chart pattern that presents a great opportunity for making excellent profits in silver. Before I show the chart, consider the last four years of silver action as summarized in the table below:

| Buy | Capture Huge Profits | Sell | Sidestep to |

| Summer 2003 | 87% ($4.43 - $8.28) | Spring 2004 | Summer 2005 |

| Summer 2005 | 129% ($6.64 - $15.20) | Spring 2006 | Summer 2007 ??? |

| Summer 2007 ??? | 150% ($12??? - $30???) | Spring 2008 ??? | Summer 2009 ??? |

Here is a graphic that illustrates the data in the table above, and shows the repetitive Silver Sidestep cycle:

An odd coincidence?

Admittedly, my table has only a few data points. Readers will be forgiven for being cautious about forecasting future investment actions based on what may prove to be little more than a coincidence. An interesting point, however, is that it is an odd pattern, as in the odd years of 2003, 2005, and quite possibly 2007 and 2009. Another interesting point is that the table corresponds quite closely to the multi year silver seasonals which show (approximately) silver bottoming in the summer and then rising through the winter.

My commentary  A Sure Thing Silver Cycle looked at silver from an annual cycle perspective, and it correctly suggested caution in December 2006. The Silver Sidestep viewpoint discussed here is different in that it views the silver market as working in two year cycles. If that viewpoint is correct, then we are in the right timeframe for a great buying opportunity.

A Sure Thing Silver Cycle looked at silver from an annual cycle perspective, and it correctly suggested caution in December 2006. The Silver Sidestep viewpoint discussed here is different in that it views the silver market as working in two year cycles. If that viewpoint is correct, then we are in the right timeframe for a great buying opportunity.

Up, Down, and Sidestep on the weekly chart

Consider the 5 year silver chart with weekly bars below. It highlights the 2003 and 2005 silver bull waves by drawing a green line from each wave’s low to its high. In the spring of 2004 and 2006, silver had a sharp and painful sell off that punctuated the end of each bull wave. After the blood stopped flowing from the falling knives of the immediate silver sell off, silver then went essentially nowhere for more than a year. I call that “nowhere” the Silver Sidestep, and my chart shows it in a colored box. At the end of the Silver Sidestep, which was in the summer of an odd year, silver began a rapid rise into a new and explosive bull wave. If that pattern persists in 2007, then silver is poised to launch into another explosive thrust higher. Take a look at the chart below:

It is possible that the $12.15 low two weeks ago was the bottom before a major run higher. It is also possible that silver will continue to dance the sidestep for another few weeks into August or even September before breaking out to begin its run with the bulls. The markets know that I am a slow learner, and they thoughtfully remind me repeatedly that I am not good at picking short term tops or bottoms. My message today is not about which week will have the bottom tic of the sidestep correction, but it is about the huge payoff that is possible for those who accumulate their position in this timeframe.

Fools rush in, but this Optimist buys a little at a time

My optimistic advice to all who are persuaded by the chart above is to not try to buy their maximum position in one single purchase, but to phase in their position over a reasonable amount of time. For example, I have been buying into this sidestep pattern for much of the last month. My goal has been to get a good average of buys at prices that are lower, but may be a little higher too, so that overall I have a reasonable average for my purchases. I purchase only with fully paid resources, and I do not recommend any margin or leverage for purchasing silver. I update my  charts daily and weekly, so readers can see my perspective on precious metals whenever they like.

charts daily and weekly, so readers can see my perspective on precious metals whenever they like.

No guarantees. None. Really, none at all!

As indicated in the disclaimer at the bottom, this commentary is not investment advice. I have had more than my share of viewpoints which the markets proved to be incorrect, and I do not encourage any reader to blindly follow my investment footsteps. I will be happy, however, if I have contributed a useful perspective to readers who are interested. Cheers!

* * * Notice * * *

This commentary presents only the viewpoints of the Optimist, and it is intended only for perspective and entertainment. Please do not interpret any portion of this work as investment advice. If any of the concepts discussed here appeal to you, then you must do the work to decide if and when and how you should invest. The Optimist does not ask for any profits you make, and he cannot be liable for any losses incurred as a result of your investment decisions. The Optimist wishes you the best of luck in whatever you decide to do or not to do. Cheers!

Reader contributions are welcome, and

excerpts will be added to this presentation.

Please send comments or suggestions to the Optimist:

Email: