Deflatuation in Silver & Gold

An optimistic error in the meaning of deflation (Published 4/12/06)

Other analysts have consistently made the point that inflation and deflation can only be measured in terms of increases or decreases in the quantity of money supply. Although I must agree philosophically, my concern is how much things cost and how little I have left after paying the ever higher costs of rising bills. Rather than argue with others about definitions of inflation and deflation, the Optimist chooses the more productive path of defining the new terms of inflatuation and deflatuation to mean what seems intuitive to him. Note to readers: This is a serious discussion, and the Optimist will not take kindly to odiferous puns about FED inflatuation in handling the nation's money.

Deflatuation is the answer, and now is the time

The Optimist confesses that in his youthful and less experienced past,  he considered that deflation (which he thought of as paper money buying more essential stuff than it did previously) was possible only if the FED made a decision to push the U.S. economy into a deflationary recession worse than the 1930s. Since the political pressure would increase at least as fast as the nation's economic pain, the Optimist concluded that our fearless leaders would not be cowered into a deflationary retreat to honest money when they could continue to boldly advance by simply printing more paper at a faster rate. Although that is still the way that he wants to bet, the Optimist has reexamined the terms he has used a little too loosely, and he has come to a new conclusion. The newsletter writers who talk endlessly about deflation (for example, see Y.Y. comments at the bottom of

he considered that deflation (which he thought of as paper money buying more essential stuff than it did previously) was possible only if the FED made a decision to push the U.S. economy into a deflationary recession worse than the 1930s. Since the political pressure would increase at least as fast as the nation's economic pain, the Optimist concluded that our fearless leaders would not be cowered into a deflationary retreat to honest money when they could continue to boldly advance by simply printing more paper at a faster rate. Although that is still the way that he wants to bet, the Optimist has reexamined the terms he has used a little too loosely, and he has come to a new conclusion. The newsletter writers who talk endlessly about deflation (for example, see Y.Y. comments at the bottom of  Is Silver or Gold Better?) are right, sort of, but their projected timing is too far in the future. The correct answer is that the real money gas is exiting financial bubbles now as we speak, and that deflatuation is not only our destiny, but it is our inescapable present as well!

Is Silver or Gold Better?) are right, sort of, but their projected timing is too far in the future. The correct answer is that the real money gas is exiting financial bubbles now as we speak, and that deflatuation is not only our destiny, but it is our inescapable present as well!

Deflatuation and inflatuation defined

Come on, guys. We are trying to have a serious academic discussion here. Let's leave the snickering thoughts about deflatuation gas exiting the financial bubbles behind. The Optimist thinks it stinks to make puns about a subject as pungently intense as deflatuation. Since inflatuation and deflatuation are my own made up words, I can conveniently define them to mean increases or decreases in the real money costs of essential items. If that sounds too simple to be useful, take another look at the microscopic print. What are essential items, and why not just consider everything? How does one measure costs? What is real money? Great! We are finally beginning to get into meaningful content. The Optimist considers essential items to be food, shelter, energy, medical, clothes, and transportation. The millions of other goods (ranging from computers and electronic toys to expensive imported cars and caviar) and services (from mega store greeter to mud bath massager at exclusive resort spas) are all relevant to the overall price environment, but differ from essentials in one very significant way. People must buy essentials regardless of the price, but people can choose to do without a few of the non-essentials, many of which did not even exist a decade or two ago.

How has the USA measured costs for the last hundred years?

Stupid question, right? The obvious answer is that goods and services have been priced in dollars for more than a century. Well, hopefully those who have previously read  the Optimist's work will not be too surprised to see a different perspective here. The USA has actually used three different currencies during the last century. Until 1933 when FDR confiscated gold, everything was priced in gold and silver. Paper certificates really were as good as gold and silver since paper was freely interchangeable with the real precious metal which backed the value of the paper. Think of those dollars (which were interchangeable with gold and silver) as colored green for good paper. Between 1933 and 1971, everything in the USA was priced in a different type of dollar. Although Americans could still exchange the new breed of dollar for silver, only foreigners could get gold for the dollar. Those transition dollars should have been colored yellow for questionable value. After Nixon slammed shut the foreign gold window in 1971, the Federal Reserve Note (FRN) was only a piece of paper which people continued to accept in payment, but only because they had no alternative to doing so. The current FRN notes we are required to accept as payment should be colored a bright red to match the rage that people will feel when they find out the truth that those government IOU Nothing notes have no intrinsic value.

the Optimist's work will not be too surprised to see a different perspective here. The USA has actually used three different currencies during the last century. Until 1933 when FDR confiscated gold, everything was priced in gold and silver. Paper certificates really were as good as gold and silver since paper was freely interchangeable with the real precious metal which backed the value of the paper. Think of those dollars (which were interchangeable with gold and silver) as colored green for good paper. Between 1933 and 1971, everything in the USA was priced in a different type of dollar. Although Americans could still exchange the new breed of dollar for silver, only foreigners could get gold for the dollar. Those transition dollars should have been colored yellow for questionable value. After Nixon slammed shut the foreign gold window in 1971, the Federal Reserve Note (FRN) was only a piece of paper which people continued to accept in payment, but only because they had no alternative to doing so. The current FRN notes we are required to accept as payment should be colored a bright red to match the rage that people will feel when they find out the truth that those government IOU Nothing notes have no intrinsic value.

What is an ounce of gold worth?

So what happened to the value of gold during the transition from a dollar that was as good as gold before 1933 to today's FRN that is just printed paper? The Optimist's viewpoint may surprise some people, but his answer is that nothing happened to the value of gold over more than the past two centuries. An ounce of gold in the 1800s was still an ounce of gold in the 1900s. An ounce of gold today continues to be worth an ounce of gold, and it will likely retain that same value for the foreseeable future. Despite the deterioration in the value of paper since 1933, the fact that an ounce of gold is always worth the same precious and desirable ounce of gold is one of the most enduring aspects which makes gold (and silver, for the same reason) real money that preserves purchasing power and truly provides a store of wealth.

The price of gold in dollars

Quickly before the mutiny gathers momentum, let me assure all readers that I am aware that gold is priced in dollars (or another comparable paper currency), and that the dollar price frequently fluctuates. Here we begin the journey that convinced the Optimist that deflatuation is our present and our inevitable future fate. Gold and silver are not alone in being priced in paper dollars. The simple fact is that all of our goods and services are also priced in FRNs, and those prices similarly change substantially over the years. As shown above, however, the value of an ounce of gold or silver has remained constant at exactly one ounce of gold or silver over centuries. So the price of gold and silver measured in dollars changes substantially but the value remains constant? Although that sounds reminiscent of the Zen riddle about the sound of one hand clapping, the statement is true and the explanation is very simple.

The price of everything in gold

We cannot directly compare the dollar prices of gold, silver and all other goods and services over centuries because we are measuring prices the wrong way. Instead of calculating the number of dollars it takes to purchase an ounce of gold or silver, or any good or service, we need to use the stable value of gold to determine the changes in the prices of everything. For example, the current value of an average house is a little less than 400 ounces of gold and a share of Microsoft stock is around 0.05 ounces of gold. Gold has the constant value that we need to make meaningful comparisons over time. The price of the FRN changes significantly when measured by the yardstick of gold's constant value. Indeed, the full concepts of inflation and deflation are directly attributed to changes in the quantity of FRN paper available to push dollar prices higher or lower, while an ounce of gold stubbornly retains exactly the same value of one ounce of gold.

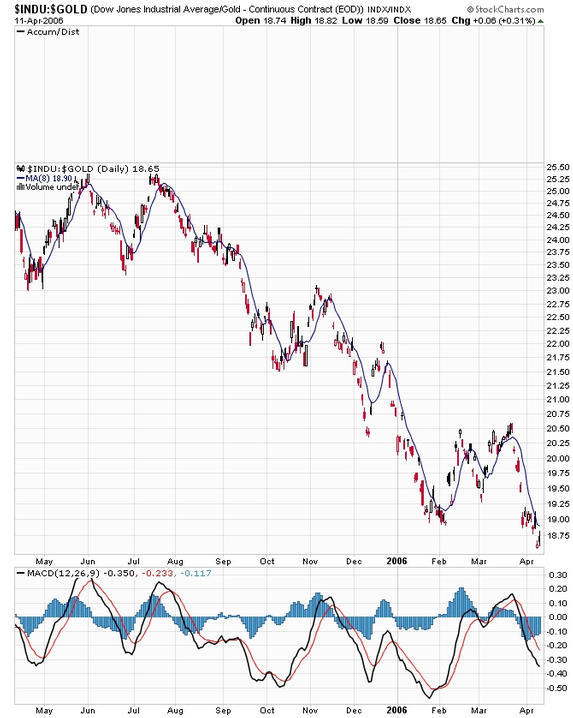

Changes in the amount of essential stuff gold buys

The easiest way to see whether we are in inflatuation (so that it takes more gold to buy essential things) or deflatuation (where less gold buys more significant stuff) is to look at charts which show the trends over time of prices measured in the constant value of gold. Since those charts are not readily available, the Optimist created a few example charts by dividing the FRN cost of things by the FRN cost of gold. The charts below show that the price when computed in ounces of gold of houses, stocks, oil, and most other commodities (measured by the CRB Index) may have risen in the past, but are solidly declining now. The currently declining prices (measured in ounces of gold with constant value) across the board demonstrates that we are now in a state of deflatuation, where real prices of essential things are consistently being reduced over time.

How would gold do in deflation?

Some forecasters who evoke concerns about possible deflation comparable to the sharp price declines during the 1930s at the same time predict that the FRN price of gold will continue to rise. Their view is that gold is not only a great hedge against the obvious price inflation we see now, but that gold will also be a great hedge against the future price deflation they are sure lies ahead. In an earlier commentary, the Optimist concluded that  deflation is improbable because the FED will always have the ability to prevent deflation by simply printing more FRN paper, and our political system would not reward politicians who inflict on voters the optional pain of deflation in addition to the heavy burden of depression which is unavoidable. For the sake of argument here, however, let's assume that politicians finally find the courage to stop spending money the nation does not have, and that the FED simultaneously stops printing additional FRN paper and related credit. In that unlikely situation, the persistent pressure due to high levels of debt would result in an environment of deflation. Just as in the 1930s, people who have debts (which is just about everyone now) would be forced to cut spending on new purchases (which would directly lower prices as sellers slash inventories and decimate jobs) and to begin selling some of their previously purchased possessions to raise needed cash (which would further hammer prices lower). Since this argument presupposes (regardless of the low probability in reality) that politicians would ignore the strident calls for political intervention to ease the economic pain, and that the FED would similarly discover the old economic axiom that printing excess FRN paper or creating credit doesn't buy a free lunch, then it would soon be clear to everyone that with no new money being injected into the system, and with the few remaining jobs rapidly being terminated, that all the debt slaves in America would desperately need to get more FRN paper to service their debts. If a small proportion of the debt slaves had the earlier wisdom to purchase precious metals, then consider what those desperate people would do with their stash of gold and silver when they are selling their homes, cars, and furniture at ten cents on the dollar in a frantic effort to pay down debts. In such an unlikely environment, my bet is that debt slaves would also be dumping their precious metals and jewelry for whatever they can get, and that FRN prices of gold and silver would be reduced in the same way that the FRN prices of stocks, houses, and cars would drop sharply. In a true deflation where the purchasing power of the dollar was obviously and persistently increasing, everyone from the kid with a newspaper route to the world's central bankers, would want to convert their holdings from a storage of wealth (precious metals) to dollars which multiply wealth by increasing purchasing power over time and by earning interest. The Optimist concludes that gold and silver FRN prices would suffer just like the FRN prices of everything else, if politicians and the FED made the hard decision to do the right thing and neither spend more than they have nor print additional FRNs.

deflation is improbable because the FED will always have the ability to prevent deflation by simply printing more FRN paper, and our political system would not reward politicians who inflict on voters the optional pain of deflation in addition to the heavy burden of depression which is unavoidable. For the sake of argument here, however, let's assume that politicians finally find the courage to stop spending money the nation does not have, and that the FED simultaneously stops printing additional FRN paper and related credit. In that unlikely situation, the persistent pressure due to high levels of debt would result in an environment of deflation. Just as in the 1930s, people who have debts (which is just about everyone now) would be forced to cut spending on new purchases (which would directly lower prices as sellers slash inventories and decimate jobs) and to begin selling some of their previously purchased possessions to raise needed cash (which would further hammer prices lower). Since this argument presupposes (regardless of the low probability in reality) that politicians would ignore the strident calls for political intervention to ease the economic pain, and that the FED would similarly discover the old economic axiom that printing excess FRN paper or creating credit doesn't buy a free lunch, then it would soon be clear to everyone that with no new money being injected into the system, and with the few remaining jobs rapidly being terminated, that all the debt slaves in America would desperately need to get more FRN paper to service their debts. If a small proportion of the debt slaves had the earlier wisdom to purchase precious metals, then consider what those desperate people would do with their stash of gold and silver when they are selling their homes, cars, and furniture at ten cents on the dollar in a frantic effort to pay down debts. In such an unlikely environment, my bet is that debt slaves would also be dumping their precious metals and jewelry for whatever they can get, and that FRN prices of gold and silver would be reduced in the same way that the FRN prices of stocks, houses, and cars would drop sharply. In a true deflation where the purchasing power of the dollar was obviously and persistently increasing, everyone from the kid with a newspaper route to the world's central bankers, would want to convert their holdings from a storage of wealth (precious metals) to dollars which multiply wealth by increasing purchasing power over time and by earning interest. The Optimist concludes that gold and silver FRN prices would suffer just like the FRN prices of everything else, if politicians and the FED made the hard decision to do the right thing and neither spend more than they have nor print additional FRNs.

Prices in dollars

Although there are no certainties, the Optimist can offer his soothing perspective that there is little chance of politicians and the FED converting to the Austrian school of finances, and that there is less chance that politicians and the FED would withstand the extreme political pressures which deflation would generate. The Optimist does not know of any comparable free society in which politicians who are popularly elected and which have central bank members who are appointed by the politicians, and which have a currency that can be printed at will by the politicians and the central bank, that has ever deliberately set course for a deflationary depression. America may have been the first in many significant accomplishments through history, but I strongly doubt that we will be the first nation in history to choose to inflict a deflationary depression on its citizens. True to his name, the Optimist sees many blue skies and happy days ahead before we need to be concerned about voluntary restrictions on political spending and central bank printing of FRN paper to result in true deflation.

So if there will not be deflation in FRN paper prices, but the values of essential items continue to deflate in their real value as measured by gold, what will happen to the FRN price of gold? The answer is that the future will continue to rhyme with the past, and what you've seen is what we'll get. From 1980 to 2001, the real prices of stocks, houses and other essential items rose too high as  gold was depressed by high real interest rates. For the foreseeable future, the real prices measured in gold of those items will correct back down in a continuing deflatuation of value, even as nominal prices in FRN paper ratchet ever higher for everything.

gold was depressed by high real interest rates. For the foreseeable future, the real prices measured in gold of those items will correct back down in a continuing deflatuation of value, even as nominal prices in FRN paper ratchet ever higher for everything.

So, what about hyperinflation?

Some analysts guess that inflation might continue to escalate at ever faster rates until the FRN value plummets toward zero in a hyperinflationary collapse. The Optimist agrees with that eventual possibility, but he takes issue with their next assertion that the result of hyperinflation will be deflation. The Optimist is aware of several currencies which have suffered hyperinflation in the last century, but he does not know of a single instance where that same currency increased in value or purchasing power after the hyperinflationary collapse. Instead of that paper currency increasing in value, its value dropped literally to zero and it was completely replaced by a new currency. It is true that just before the collapse, a loaf of bread may have cost 100,000,000 units of the old currency. After the currency replacement, it might cost only 1 unit of the new currency, but that is not a process of deflation. Changing the frame of reference from one currency to a different currency does not make the old currency more valuable or increase its purchasing power. People who use the term deflation inevitably think of the 1930s in America when the dollar gained value through deflation and then the dollar bought more stuff than in the previous decade. Since the dollar in 1930 was convertible to gold and silver, however, the dreaded deflation of the 1930s was really just another example of an increase in the purchasing power of gold. That deflation of 75 years ago was on a larger scale, but otherwise similar to the deflatuation process we see repeating today so that essentials cost less over time when the cost is measured in ounces of gold.

Silver really will be worth its weight in gold

As a final note about real value measured in ounces of gold, consider lowly silver which still doesn't get enough respect in the financial community. It is true that like gold, the FRN price of silver has sharply increased over the last few months. It is also true that at an unknown point in the future, both gold and silver will have significant corrections back down in their FRN paper prices to another exceptionally good buying point. The Optimist's positive perspective, however, is firmly focused on the real value of silver measured in ounces of gold. As with the earlier charts, that value is computed by dividing the FRN price of silver by the FRN price of gold. The chart below shows the results. Where houses, stocks, energy, and commodities all show real values which are in deflatuation compared to gold, the real value of silver is in inflatuation. Considering that there is substantially less silver than gold available for industry or investors, and that the continuing deficit in silver production versus consumption continuously reduces the amount of available silver, and that an inevitable recession will further reduce the amount of  silver produced as a by-product of base metal mining, the Optimist is happy to reinforce the clear chart message below so that all readers can be happy with maximizing the allocation of their investment funds for real physical silver.

silver produced as a by-product of base metal mining, the Optimist is happy to reinforce the clear chart message below so that all readers can be happy with maximizing the allocation of their investment funds for real physical silver.

* * * Notice * * *

This commentary presents only the viewpoints of the Optimist, and it is intended only for perspective and entertainment. Please do not interpret any portion of this work as investment advice. If any of the concepts discussed here appeal to you, then you must do the work to decide if and when and how you should invest. The Optimist does not ask for any profits you make, and he cannot be liable for any losses incurred as a result of your investment decisions. The Optimist wishes you the best of luck in whatever you decide to do or not to do. Cheers!

Reader contributions are welcome, and

excerpts will be added to this presentation.

Please send comments or suggestions to the Optimist:

Email: